Express Scripts 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79 Express Scripts 2013 Annual Report

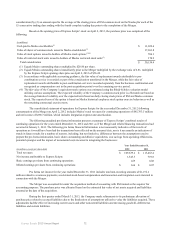

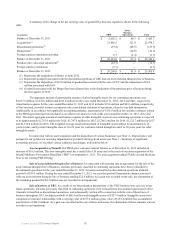

Sale of EAV. In 2012, we recorded impairment charges associated with EAV totaling $11.5 million, which was

comprised of $2.0 million of goodwill and $9.5 million of intangible assets and reflected fair value. The write-down of

intangible assets was comprised of customer relationships with a carrying value of $3.6 million (gross value of $5.0 million less

accumulated amortization of $1.4 million) and trade names with a carrying value of $5.9 million (gross value of $7.0 million

less accumulated amortization of $1.1 million).

Sale of Liberty. In 2012, we recorded an impairment charge associated with Liberty totaling $23.0 million to

reflect fair value. The write-down was comprised of customer relationships with a carrying value of $24.2 million (gross value

of $35.0 million less accumulated amortization of $10.8 million) and trade names with a carrying value of $6.6 million (gross

value of $7.0 million less accumulated amortization of $0.4 million). This charge was allocated to these assets on a pro rata

basis using the carrying values as of September 30, 2012.

Sale of CYC. In 2012, we completed the sale of CYC, which was included in our Other Business Operations

segment. In connection with the sale of this line of business, goodwill of $12.0 million and trade names of $0.7 million were

eliminated upon the sale of the business. As a gain was recorded on the sale, the elimination of these amounts was not recorded

as an impairment.