Express Scripts 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 66

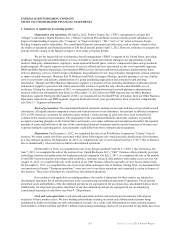

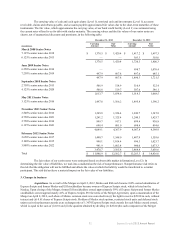

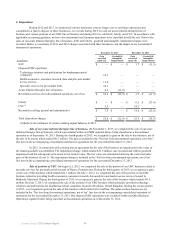

have an indefinite life, are amortized on a straight-line basis, which approximates the pattern of benefit, over periods from 5 to

20 years for customer-related intangibles, 10 years for trade names and 2 to 30 years for other intangible assets (see Note 6 -

Goodwill and other intangibles).

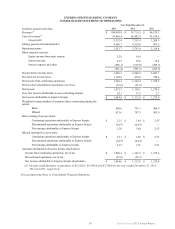

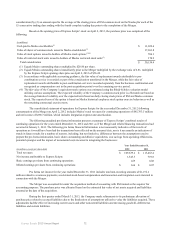

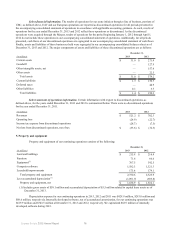

The amount of other intangible assets reported is net of accumulated amortization of $4,088.0 million and $2,156.2

million at December 31, 2013 and 2012, respectively. Amortization expense for our continuing operations for other intangible

assets, excluding deferred financing fees, recorded in selling, general and administrative expense (“SG&A”) was $1,904.2

million, $1,474.4 million and $40.7 million for the years ended December 31, 2013, 2012 and 2011, respectively. In accordance

with applicable accounting guidance, amortization expense for customer contracts related to the PBM agreement has been

included as an offset to revenue in the amount of $114.0 million for each of the years ended December 31, 2013, 2012 and

2011. Amortization expense for deferred financing fees included in interest expense was $19.6 million, $43.6 million and $81.0

million in 2013, 2012 and 2011, respectively. In 2012 and 2011, these amounts include fees incurred related to the termination

or partial termination of bridge loan financing in connection with business combinations in process during each respective

period.

Self-insurance accruals. We maintain insurance coverage for claims that arise in the normal course of business.

Where insurance coverage is not available, or, in our judgment, is not cost-effective, we maintain self-insurance accruals to

reduce our exposure to future legal costs, settlements and judgments. Self-insured losses are accrued based upon estimates of

the aggregate liability for the costs of uninsured claims incurred using certain actuarial assumptions followed in the insurance

industry and our historical experience (see Note 12 - Commitments and contingencies). It is not possible to predict with

certainty the outcome of these claims, and we can give no assurances any losses, in excess of our insurance and any self-

insurance accruals, will not be material.

Fair value of financial instruments. The carrying value of cash and cash equivalents, restricted cash and

investments, accounts receivable, claims and rebates payable and accounts payable approximated fair values due to the short-

term maturities of these instruments. The fair value, which approximates the carrying value, of our bank credit facility was

estimated using the current rates offered to us for debt with similar maturity (see Note 2 - Fair value measurements).

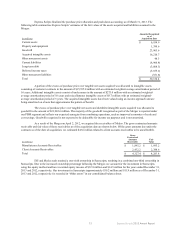

Revenue recognition. Revenues from our PBM segment are earned by dispensing prescriptions from our home

delivery and specialty pharmacies, processing claims for prescriptions filled by retail pharmacies in our networks, and

providing services to drug manufacturers, including administration of discount programs (see also “Rebate accounting” below).

Revenues from dispensing prescriptions from our home delivery pharmacies are recorded when drugs are shipped.

At the time of shipment, our earnings process is complete; the obligation of our customer to pay for the drugs is fixed and, due

to the nature of the product, the member may not return the drugs or receive a refund.

Revenues from our specialty line of business are from providing medications/pharmaceuticals for diseases that rely

upon high-cost injectable, infused, oral or inhaled drugs which have sensitive handling and storage needs; bio-pharmaceutical

services including marketing, reimbursement and customized logistics solutions; and providing fertility services to providers

and patients. Specialty revenues earned by our PBM segment are recognized at the point of shipment. At the time of shipment,

we have performed substantially all of our obligations under our customer contracts and do not experience a significant level of

reshipments. Appropriate reserves are recorded for discounts and contractual allowances which are estimated based on

historical collections over a recent period. Any differences between our estimates and actual collections are reflected in

operations in the period in which payment is received. Differences may affect the amount and timing of our revenues for any

period if actual performance varies from our estimates. Allowances for returns are estimated based on historical return trends.

Revenues from our PBM segment are also derived from the distribution of pharmaceuticals requiring special

handling or packaging where we have been selected by the pharmaceutical manufacturer as part of a limited distribution

network and the distribution of pharmaceuticals through Patient Assistance Programs where we receive a fee from the

pharmaceutical manufacturer for administrative and pharmacy services for the delivery of certain drugs free of charge to

doctors for their low-income patients. These revenues include administrative fees received from these programs.

Revenues related to the distribution of prescription drugs by retail pharmacies in our networks consist of the

prescription price (ingredient cost plus dispensing fee) negotiated with our clients, including the portion to be settled directly by

the member (co-payment), plus any associated administrative fees. These revenues are recognized when the claim is processed.

When we independently have a contractual obligation to pay our network pharmacy providers for benefits provided to our

clients’ members, we act as a principal in the arrangement and we include the total prescription price as revenue in accordance

with applicable accounting guidance. Although we generally do not have credit risk with respect to retail co-payments, the

primary indicators of gross treatment are present. When a prescription is presented by a member to a retail pharmacy within our

network, we are solely responsible for confirming member eligibility, performing drug utilization review, reviewing for drug-

to-drug interactions, performing clinical intervention, which may involve a call to the member’s physician, communicating plan