Express Scripts 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95 Express Scripts 2013 Annual Report

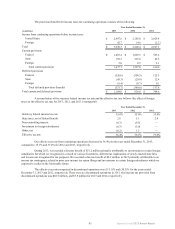

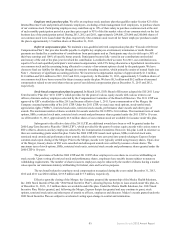

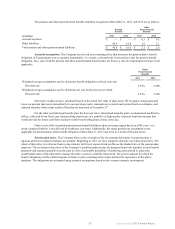

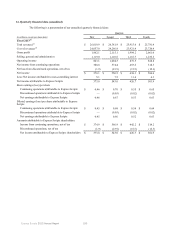

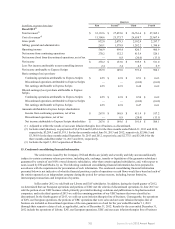

For measurements using significant unobservable inputs (Level 3) during 2013, a reconciliation of the beginning

and ending balances is as follows:

(in millions) Hedge Funds

Balance at beginning of year $—

Purchases 42.0

Unrealized gains 0.9

Balance at end of year $ 42.9

The methods described above may produce a fair value calculation that may not be indicative of net realizable

value or reflective of future fair values. Furthermore, while the plan believes its valuation methods are appropriate and

consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of

certain financial instruments could result in a different fair value measurement.

Cash flows.

Employer Contributions. Under the current actuarial assumptions, there is no minimum contribution required for

the 2013 plan year. The Company does not expect to contribute any cash payments during 2014.

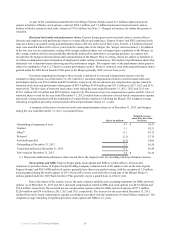

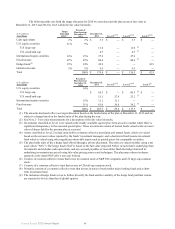

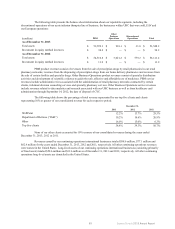

Estimated Future Benefit Payments. As of December 31, 2013, the following benefit payments are expected to be

made (in millions):

Year Ended December 31,

Pension

Benefits

Other

Postretirement

Benefits

2014 $ 15.5 $ 0.3

2015 14.1 0.3

2016 13.7 0.3

2017 13.3 0.2

2018 13.1 0.2

2019-2023 63.8 0.7

12. Commitments and contingencies

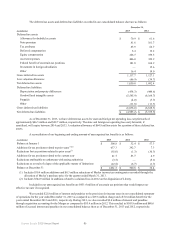

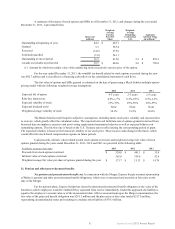

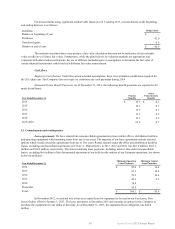

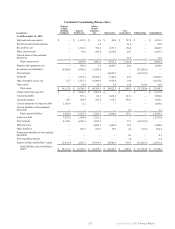

Lease agreements. We have entered into noncancellable agreements to lease certain offices, distribution facilities

and operating equipment with remaining terms from one to ten years. The majority of our lease agreements include renewal

options which would extend the agreements from one to five years. Rental expense under the office and distribution facilities

leases, excluding our discontinued operations (see Note 4 - Dispositions), in 2013, 2012 and 2011 was $83.8 million, $103.6

million and $30.2 million, respectively. The future minimum lease payments, including interest, due under noncancellable

leases, excluding the facilities of the discontinued operations of our held for sale entities of our European operations, are shown

below (in millions):

Year Ended December 31,

Minimum Operating

Lease Payments

Minimum Capital

Lease Payments

2014 $ 85.0 $ 14.4

2015 61.1 14.4

2016 53.5 14.4

2017 42.6 0.2

2018 38.4 —

Thereafter 85.5 —

Total $ 366.1 $ 43.4

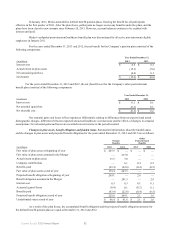

In November 2012, we entered into a four-year capital lease for equipment to be used in our Fair Lawn, New

Jersey facility effective January 1, 2013. The lease terminates in December 2016 and contains an option for the Company to

purchase the equipment for one dollar at that time. As of December 31, 2013, the capitalized lease obligation was $42.0

million.