Express Scripts 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77 Express Scripts 2013 Annual Report

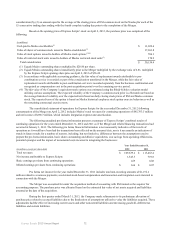

In November 2012, we entered into a four-year capital lease for equipment to be used in our Fair Lawn, New

Jersey facility, with a commencement date of January 1, 2013. The assets obtained with the capital lease are included in the

Equipment line disclosed in the table above. As of December 31, 2013, the capitalized lease obligation was $42.0 million (see

Note 12 - Commitments and contingencies).

Under certain of our operating leases for facilities in which we operate home delivery and specialty pharmacies, we

are required to remove improvements and equipment upon surrender of the property to the landlord and convert the facilities

back to office space. Our asset retirement obligation for our continuing operations was $10.1 million and $4.9 million at

December 31, 2013 and 2012, respectively.

In the first quarter of 2011, we ceased fulfilling prescriptions from our home delivery dispensing pharmacy in

Bensalem, Pennsylvania. We are currently in the process of closing this facility, which is scheduled to be completed in 2014.

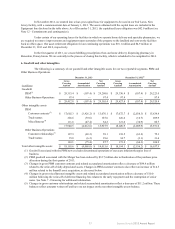

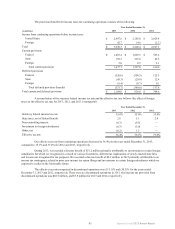

6. Goodwill and other intangibles

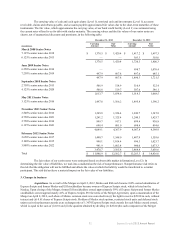

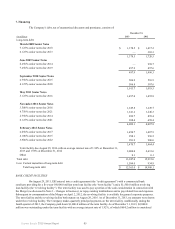

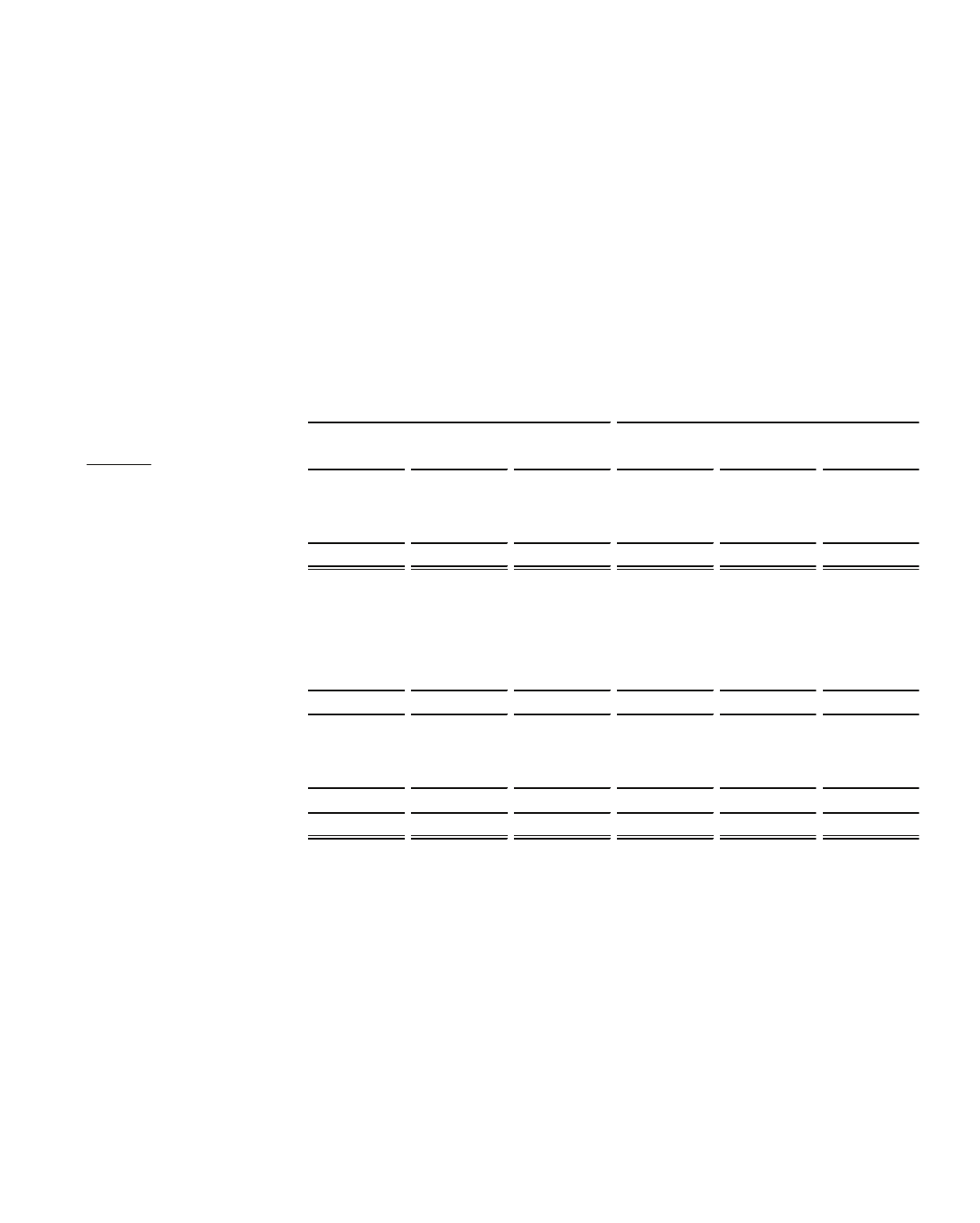

The following is a summary of our goodwill and other intangible assets for our two reportable segments, PBM and

Other Business Operations.

December 31, 2013 December 31, 2012(1)

(in millions)

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Goodwill

PBM(2) $ 29,315.4 $ (107.4) $ 29,208.0 $ 29,330.4 $ (107.4) $ 29,223.0

Other Business Operations 97.4 — 97.4 97.4 — 97.4

$ 29,412.8 $ (107.4) $ 29,305.4 $ 29,427.8 $ (107.4) $ 29,320.4

Other intangible assets

PBM

Customer contracts(3) $ 17,602.3 $ (3,926.2) $ 13,676.1 $ 17,672.7 $ (2,038.3) $ 15,634.4

Trade names 226.6 (39.0) 187.6 226.6 (16.7) 209.9

Miscellaneous(4) 111.6 (47.4) 64.2 121.6 (34.9) 86.7

17,940.5 (4,012.6) 13,927.9 18,020.9 (2,089.9) 15,931.0

Other Business Operations

Customer relationships(5) 127.3 (69.2) 58.1 138.5 (63.2) 75.3

Trade names 35.8 (6.2) 29.6 34.7 (3.1) 31.6

163.1 (75.4) 87.7 173.2 (66.3) 106.9

Total other intangible assets $ 18,103.6 $ (4,088.0) $ 14,015.6 $ 18,194.1 $ (2,156.2) $ 16,037.9

(1) Goodwill associated with the PBM now excludes discontinued operations of our acute infusion therapies line of

business.

(2) PBM goodwill associated with the Merger has been reduced by $12.7 million due to finalization of the purchase price

allocation during the first quarter of 2013.

(3) Changes in gross PBM customer contracts and related accumulated amortization reflect a decrease of $84.4 million

related to the write-off of fully depreciated assets. Changes in PBM customer contracts also reflect an increase of $14.5

million related to the SmartD asset acquisition, as discussed below.

(4) Changes in gross miscellaneous intangible assets and related accumulated amortization reflect a decrease of $10.0

million following the write-off of deferred financing fees related to the early repayment and the redemption of senior

notes. See Note 7 - Financing for additional information.

(5) Changes in gross customer relationships and related accumulated amortization reflect a decrease of $11.2 million. These

balances reflect amounts written off and have no net impact on the net other intangible assets balance.