Express Scripts 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 78

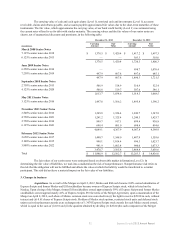

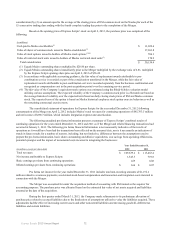

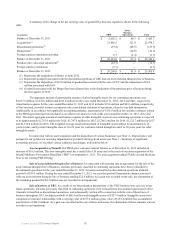

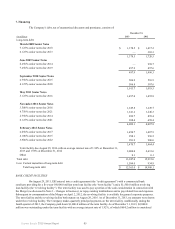

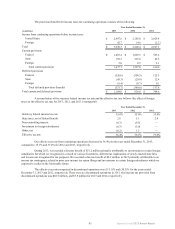

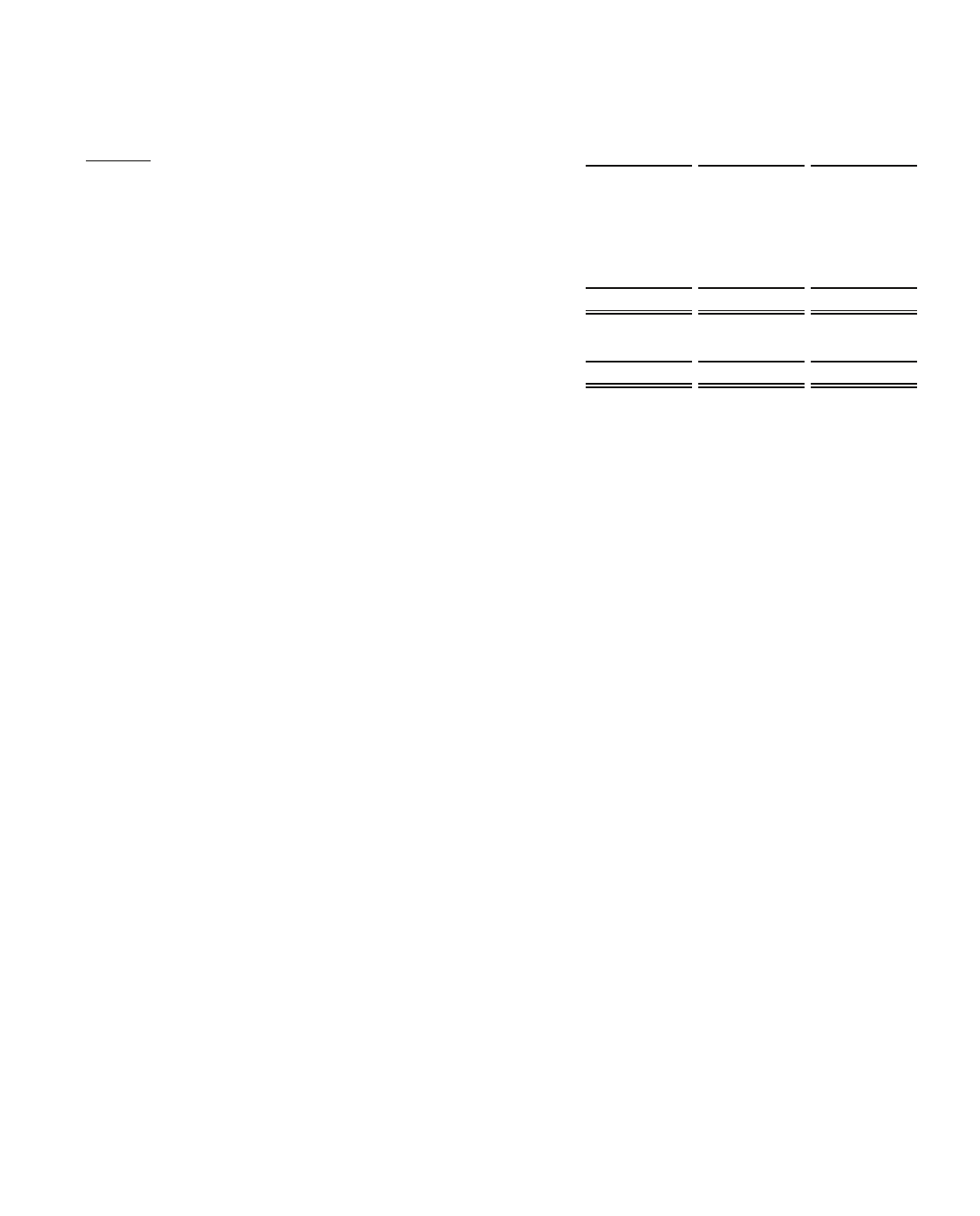

A summary of the change in the net carrying value of goodwill by business segment is shown in the following

table:

(in millions) PBM

Other

Business

Operations Total

Balance at December 31, 2011 $ 5,405.2 $ 80.5 $ 5,485.7

Acquisitions(1) 23,856.5 121.8 23,978.3

Discontinued operations(2) (39.4)(88.5)(127.9)

Dispositions(3) —(14.0)(14.0)

Foreign currency translation and other 0.7 (2.4)(1.7)

Balance at December 31, 2012 $ 29,223.0 $ 97.4 $ 29,320.4

Purchase price allocation adjustment(4) (12.7)—

(12.7)

Foreign currency translation (2.3)—

(2.3)

Balance at December 31, 2013 $ 29,208.0 $ 97.4 $ 29,305.4

(1) Represents the acquisition of Medco in April 2012.

(2) Represents goodwill associated with the discontinued portions of UBC and our acute infusion therapies line of business.

(3) Represents the disposition of $12.0 million of goodwill associated with the sale of CYC and the impairment of $2.0

million associated with EAV.

(4) Goodwill associated with the Merger has been adjusted due to the finalization of the purchase price allocation during

the first quarter of 2013.

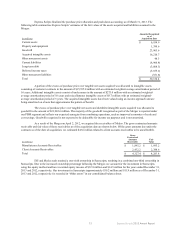

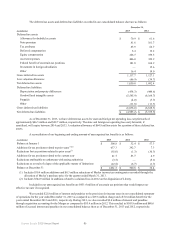

The aggregate amount of amortization expense of other intangible assets for our continuing operations was

$2,037.8 million, $1,632.0 million and $236.0 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Amortization expense for the years ended December 31, 2013 and 2012 includes $19.6 million and $43.6 million, respectively,

of fees incurred, recorded in interest expense in the consolidated statement of operations, related to our debt instruments.

Additionally, in accordance with applicable accounting guidance, amortization of $114.0 million for customer contracts related

to the PBM agreement has been included as an offset to revenues for each of the years ended December 31, 2013, 2012 and

2011. The future aggregate amount of amortization expense of other intangible assets for our continuing operations is expected

to be approximately $1,767.8 million for 2014, $1,747.4 million for 2015, $1,740.2 million for 2016, $1,322.7 million for 2017

and $1,312.0 million for 2018. The weighted-average amortization period of intangible assets subject to amortization is 16

years in total, and by major intangible class is 5 to 20 years for customer-related intangibles and 2 to 30 years years for other

intangible assets.

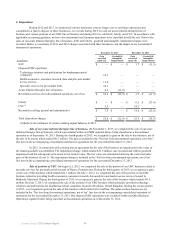

In connection with an asset acquisition and the disposition of various businesses (see Note 4 - Dispositions), and

pursuant to our policies for assessing impairment of goodwill and long-lived assets (see Note 1 - Summary of significant

accounting policies), we recorded various additions and charges, as described below.

Asset acquisition of SmartD. Our PBM gross customer contract balance as of December 31, 2013 includes an

increase of $14.5 million. This new intangible asset has a useful life of 10 years and is the result of our asset acquisition of the

SmartD Medicare Prescription Drug Plan (“PDP”) on September 1, 2013. The asset acquisition added 87,000 covered Medicare

lives to our existing PDP offering.

Sale of acute infusion therapies line of business. In connection with entering into an agreement for the sale of the

acute infusion therapies line of business, amounts previously classified in continuing operations have been reclassified to

discontinued operations for the year ended December 31, 2012. Amounts reclassified as discontinued operations included

goodwill of $39.4 million. During the year ended December 31, 2013, we recorded goodwill impairment charges associated

with our acute infusion therapies line of business totaling $32.9 million. As a gain was recorded on the sale, the elimination of

the remaining goodwill of $6.5 million was not recorded as an impairment.

Sale of portions of UBC. As a result of our determination that portions of the UBC business were not core to our

future operations, amounts previously classified in continuing operations were reclassified to discontinued operations in 2012.

Amounts reclassified as discontinued operations, and subsequently written off in connection with the sale of these lines of

business throughout 2013, included goodwill of $88.5 million and intangible assets of $157.4 million. Intangible assets were

comprised of customer relationships with a carrying value of $157.4 million (gross value of $181.4 million less accumulated

amortization of $24.0 million). As a gain was recorded on the sale of these businesses, the elimination of these amounts was not

recorded as an impairment.