Energizer 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

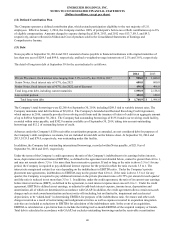

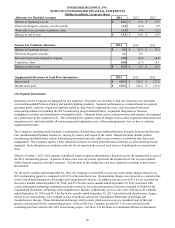

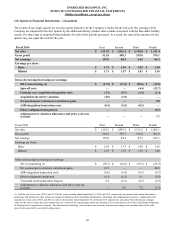

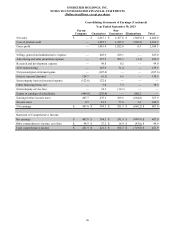

Allowance for Doubtful Accounts 2014 2013 2012

Balance at beginning of year $ 16.0 $ 15.9 $ 15.9

Provision charged to expense, net of reversals (1.3)(0.3) 2.2

Write-offs, less recoveries, translation, other (1.3)0.4 (2.2)

Balance at end of year $ 13.4 $ 16.0 $ 15.9

Income Tax Valuation Allowance 2014 2013 2012

Balance at beginning of year $ 9.5 $ 11.9 $ 12.6

Provision charged to expense 7.6 0.5 —

Reversal of provision charged to expense (3.0)(0.2)(0.8)

Translation, other (0.8)(2.7) 0.1

Balance at end of year $ 13.3 $ 9.5 $ 11.9

Supplemental Disclosure of Cash Flow Information 2014 2013 2012

Interest paid $ 120.3 $ 126.5 $ 117.5

Income taxes paid $ 115.2 $ 142.2 $ 113.0

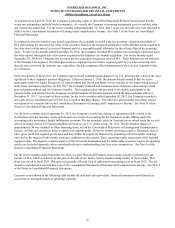

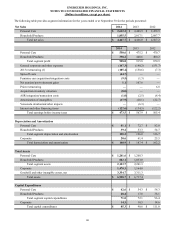

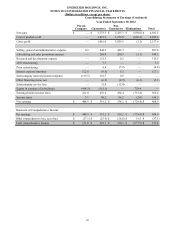

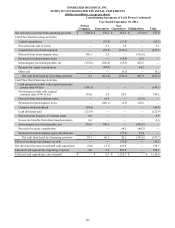

(21) Segment Information

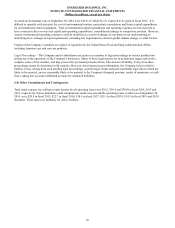

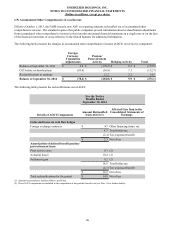

Operations for the Company are managed via two segments - Personal Care (wet shave, skin care, feminine care and infant

care) and Household Products (battery and portable lighting products). Segment performance is evaluated based on segment

operating profit, exclusive of general corporate expenses, share-based compensation costs, costs associated with most

restructuring initiatives (including the 2013 restructuring project detailed below), acquisition integration or business

realignment activities, and amortization of intangible assets. Financial items, such as interest income and expense, are managed

on a global basis at the corporate level. The exclusion from segment results of charges such as other acquisition transaction and

integration costs, and substantially all restructuring and realignment costs, reflects management's view on how it evaluates

segment performance.

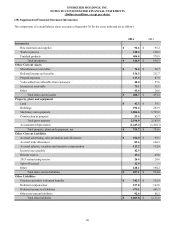

The Company's operating model includes a combination of stand-alone and combined business functions between the Personal

Care and Household Products businesses, varying by country and region of the world. Shared functions include product

warehousing and distribution, various transaction processing functions, and in some countries, a combined sales force and

management. The Company applies a fully allocated cost basis, in which shared business functions are allocated between the

segments. Such allocations are estimates, and also do not represent the costs of such services if performed on a stand-alone

basis.

Effective October 1, 2013, the Company centralized certain corporate administrative functions across the organization as part of

the 2013 restructuring project. A portion of these costs were previously reported at the segment level, but are now reported

within General corporate and other expenses. Periods prior to this change have not been adjusted to conform to this current

presentation.

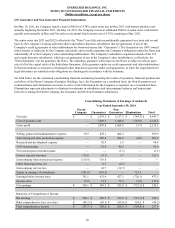

For the twelve months ended September 30, 2014, the Company recorded $92.6 in pre-tax restructuring charges related to its

2013 restructuring project as compared to $139.3 in the prior fiscal year. Restructuring charges were reported on a separate line

in the Consolidated Statements of Earnings and Comprehensive Income. In addition, pre-tax costs of $11.8 were recorded for

the twelve months ended September 30, 2014, and $5.2 for the twelve months ended September 30, 2013 associated with

certain information technology enablement activities related to our restructuring project and were included in SG&A on the

Consolidated Statements of Earnings and Comprehensive Income. Additionally, pre-tax costs of $1.0 for the twelve months

ended September 30, 2014, and $6.1 for the twelve months ended September 30, 2013 associated with obsolescence charges

related to our restructuring, were included in Cost of products sold on the Consolidated Statements of Earnings and

Comprehensive Income. These information technology and inventory obsolescence costs are considered part of the total

project costs incurred for the restructuring project. In fiscal 2012 the Company recorded $7.3 of costs associated with

consulting activities related to the 2013 restructuring project. See Note 5 of the Notes to Consolidated Financial Statements.

90