Energizer 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

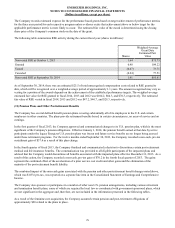

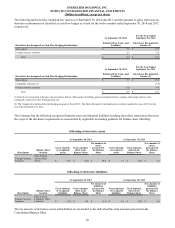

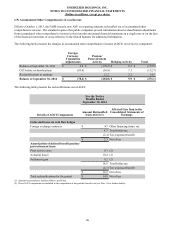

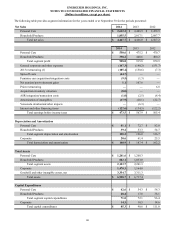

The following table provides estimated fair values as of September 30, 2014 and 2013, and the amounts of gains and losses on

derivative instruments not classified as cash flow hedges as of and for the twelve months ended September 30, 2014 and 2013,

respectively.

At September 30, 2014

For the Year Ended

September 30, 2014

Derivatives not designated as Cash Flow Hedging Relationships

Estimated Fair Value Asset

(Liability)

Gain/(Loss) Recognized in

Income (1)

Share option $ 5.6 $ 12.3

Foreign currency contracts 3.3 4.2

Total $ 8.9 $ 16.5

At September 30, 2013

For the Year Ended

September 30, 2013

Derivatives not designated as Cash Flow Hedging Relationships

Estimated Fair Value Asset

(Liability)

Gain/(Loss) Recognized in

Income (1)

Share option $ 7.7 $ 15.5

Commodity contracts (2) — (1.9)

Foreign currency contracts (3.2) 4.9

Total $ 4.5 $ 18.5

(1) Gain/(Loss) recognized in Income was recorded as follows: Share option in Selling, general and administrative expense and foreign currency and

commodity contracts in other financing item, net.

(2) The Company discontinued the zinc hedging program in fiscal 2013. The final settlement of outstanding zinc contracts resulted in a loss of $1.9 for the

year ended September 30, 2013.

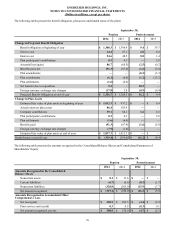

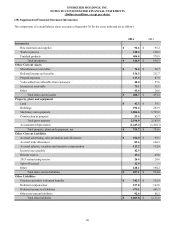

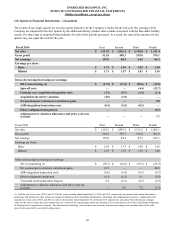

The Company has the following recognized financial assets and financial liabilities resulting from those transactions that meet

the scope of the disclosure requirements as necessitated by applicable accounting guidance for balance sheet offsetting:

Offsetting of derivative assets

At September 30, 2014 At September 30, 2013

Description

Balance Sheet

location

Gross amounts

of recognized

assets

Gross amounts

offset in the

Balance Sheet

Net amounts of

assets

presented in

the Balance

Sheet

Gross amounts

of recognized

assets

Gross amounts

offset in the

Balance Sheet

Net amounts of

assets

presented in

the Balance

Sheet

Foreign Currency

Contracts

Other Current

Assets, Other

Assets $ 19.8 $ (0.4) $ 19.4 $ 7.3 $ (0.6) $ 6.7

Offsetting of derivative liabilities

At September 30, 2014 At September 30, 2013

Description

Balance Sheet

location

Gross amounts

of recognized

liabilities

Gross amounts

offset in the

Balance Sheet

Net amounts of

liabilities

presented in

the Balance

Sheet

Gross amounts

of recognized

liabilities

Gross amounts

offset in the

Balance Sheet

Net amounts of

liabilities

presented in

the Balance

Sheet

Foreign Currency

Contracts

Other Current

Liabilities, Other

Liabilities $ (1.8) $ 0.2 $ (1.6) $ 8.6 $ (0.2) $ 8.4

The net amounts of derivative assets and liabilities are reconciled to the individual line item amounts presented in the

Consolidated Balance Sheet.

85