Energizer 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

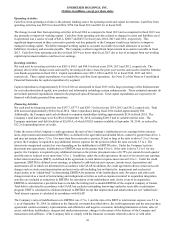

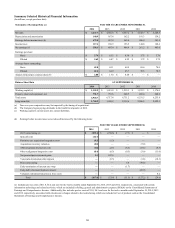

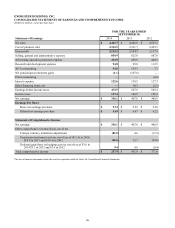

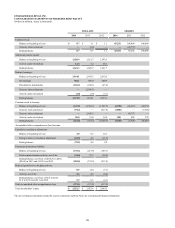

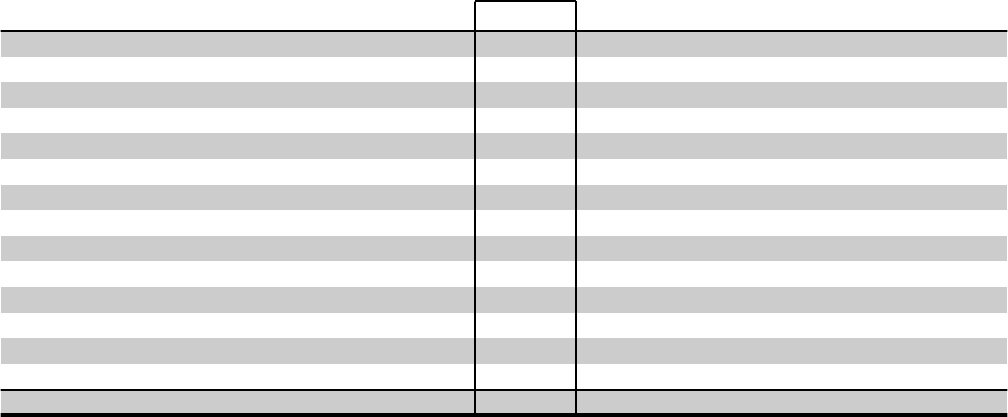

(f) Net earnings were (reduced)/increased by the following items:

FOR THE YEARS ENDED SEPTEMBER 30,

2014 2013 2012 2011 2010

2013 restructuring (g) $ (70.5) $ (97.9) $ (4.6) $ — $ —

Spin-off costs (28.1) ————

Feminine care acquisition/integration costs (6.2) (0.8) — — —

Acquisition inventory valuation (5.0) — — (4.4) —

ASR integration/transaction costs (0.6) (1.6) (5.3) (8.5) —

Other realignment/integration costs (0.3) (0.2) (0.3) (2.0) (7.4)

Net pension/post-retirement gains 0.8 67.5 — — —

Venezuela devaluation/other impacts —(6.3) — (1.8) (14.2)

Prior restructuring —— 5.7 (63.3) —

Early termination of interest rate swap —— (1.1) — —

Early debt retirement/duplicate interest —— — (14.4) —

Voluntary retirement/reduction in force costs ————0.1

Adjustments to valuation allowances and prior years tax accruals 7.7 8.3 7.0 (9.7) 6.1

Tax benefits - special foreign dividend —— — — 23.5

Total $ (102.2) $ (31.0) $ 1.4 $ (104.1) $ 8.1

(g) Includes net of tax costs of $7.6, $3.4 and zero for the twelve months ended September 30, 2014, 2013 and 2012, respectively, associated with certain

information technology and related activities, which are included in SG&A on the Consolidated Statements of Earnings and Comprehensive Income.

Additionally, this includes net of tax costs of $0.8, $3.8 and zero for the twelve months ended September 30, 2014, 2013 and 2012, respectively, associated

with obsolescence charges related to the exit of certain non-core product lines as a result of our restructuring, which are included in Cost of products sold on

the Consolidated Statements of Earnings and Comprehensive Income.

53