Energizer 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

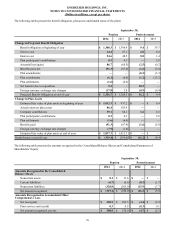

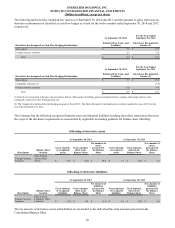

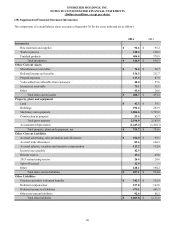

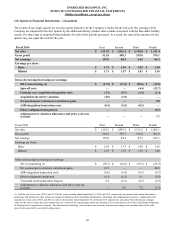

Fair Value Hierarchy Accounting guidance on fair value measurements for certain financial assets and liabilities requires that

assets and liabilities carried at fair value be classified in one of the following three categories:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs reflecting the reporting entity’s own assumptions or external inputs from inactive markets.

Under the fair value accounting guidance hierarchy, an entity is required to maximize the use of quoted market prices and

minimize the use of unobservable inputs. The following table sets forth the Company’s financial assets and liabilities, which are

carried at fair value, as of September 30, 2014 and 2013 that are measured on a recurring basis during the period, segregated by

level within the fair value hierarchy:

Level 2

September 30,

2014 2013

Assets/(Liabilities) at estimated fair value:

Deferred Compensation $ (157.3) $ (167.6)

Derivatives - Foreign Currency contracts 17.8 (1.7)

Share Option 5.6 7.7

Total Liabilities at estimated fair value $ (133.9) $ (161.6)

At September 30, 2014 and 2013, the Company had no level 1 or level 3 financial assets or liabilities.

See Note 10 of the Notes to Consolidated Financial Statements for further discussion of deferred compensation liabilities.

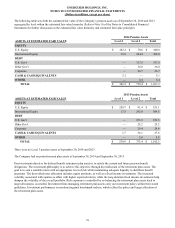

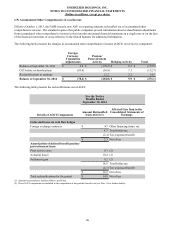

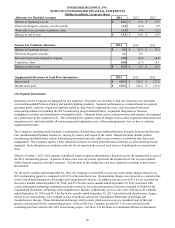

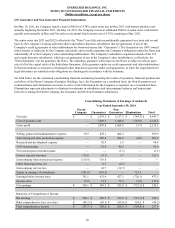

At September 30, 2014 and 2013, the fair market value of fixed rate long-term debt was $2,056.5 and $2,262.3, respectively,

compared to its carrying value of $1,998.9 and $2,138.8, respectively. The book value of the Company’s variable rate debt

approximates estimated fair value. The estimated fair value of the long-term debt is estimated using yields obtained from

independent pricing sources for similar types of borrowing arrangements. The estimated fair value of fixed rate long-term debt

has been determined based on level 2 inputs.

Due to the nature of cash and cash equivalents and short-term borrowings, including notes payable, carrying amounts on the

balance sheets approximate estimated fair value. The estimated fair value of cash and cash equivalents and short-term

borrowings have been determined based on level 2 inputs.

At September 30, 2014, the estimated fair value of foreign currency contracts and the Company's share option as described

above is the amount that the Company would receive or pay to terminate the contracts, considering first, quoted market prices

of comparable agreements, or in the absence of quoted market prices, such factors as interest rates, currency exchange rates and

remaining maturities. The estimated fair value of the Company's unfunded deferred compensation liability is determined based

upon the quoted market prices of the Energizer Common Stock Unit Fund as well as other investment options that are offered

under the plan.

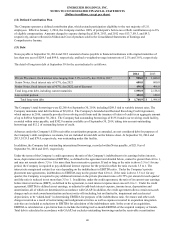

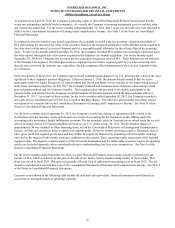

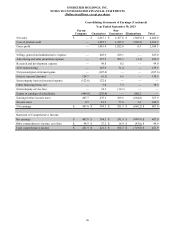

(17) Environmental and Legal Matters

Government Regulation and Environmental Matters – The operations of the Company, like those of other companies engaged

in the Household Products and Personal Care businesses, are subject to various federal, state, foreign and local laws and

regulations intended to protect the public health and the environment. These regulations relate primarily to worker safety, air

and water quality, underground fuel storage tanks and waste handling and disposal. The Company has received notices from the

U.S. Environmental Protection Agency, state agencies and/or private parties seeking contribution, that it has been identified as a

“potentially responsible party” (PRP) under the Comprehensive Environmental Response, Compensation and Liability Act, and

may be required to share in the cost of cleanup with respect to a number of federal “Superfund” sites. It may also be required to

share in the cost of cleanup with respect to state-designated sites or other sites outside of the U.S.

86