Energizer 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

On March 10, 2014, the Venezuelan government announced the inception of the SICAD II program as an additional mechanism

to purchase foreign currency. The SICAD II program does not supersede the Cadivi/Cencoex for essential imports (currently at

6.30 bolivars per U.S. dollar) nor SICAD I (equal to 12.00 bolivars per U.S. dollar as of September 30, 2014).

Thus far, the Company has not been invited to participate in the SICAD I auction process nor chosen to utilize the SICAD II

auction system. Whether we will be able to access or participate in either SICAD system in the foreseeable future or what

volume of currency exchange we would be able to transact through these alternative mechanisms is unknown at the present

time. We continue to monitor these situations, including the impact restrictions may have on our future business operations. At

this time, the Company is unable to predict with any degree of certainty how recent and future developments in Venezuela will

affect our Venezuela operations.

For all of fiscal 2014, the Company’s overall results in Venezuela are reflected in the Consolidated Financial Statements at the

official exchange rate equal to 6.30 bolivars per U.S. dollar. During fiscal year 2014, the Company received $9.5 of payments

at the 6.30 bolivars per U.S. dollar rate for household and personal care products previously imported in accordance with Non-

National Production Certificates (CNP) executed between the Company and the Venezuela government. In addition, the

Company is awaiting payment for an additional $5.6 as of September 30, 2014 (at the 6.30 bolivars per U.S. dollar rate) for

household and personal care products imported in accordance with the second CNP executed between the Company and the

Venezuela government.

Depending on the ultimate transparency and liquidity of the SICAD I and II markets, it is possible that in future periods the

Company may need to remeasure a portion or substantially all of its net monetary balances at a rate other than the official

exchange rate of 6.30 currently being used. To the extent that the SICAD I or II rates are higher than the official exchange rate

at the time our net monetary balances are remeasured, this could result in an additional devaluation charge, which could be

material. In addition, operating results translated using a rate higher than the official exchange rate of 6.30 bolivars to one U.S.

dollar would result in a reduction in earnings, which could be material.

At September 30, 2014, the Company had approximately $79 in net monetary assets in Venezuela at the official exchange rate

of 6.30 to one U.S. dollar. However, due to the future uncertainty and volatility of the foreign exchange markets in Venezuela

we believe that any future remittance of our local currency cash balances from Venezuela would be substantially less than the

amount recorded as of September 30, 2014 on our Consolidated Balance Sheets per U.S. GAAP. As such, we cannot give

assurance as to the exchange rate at which such balances might be converted in the future and/or when we might be able to

repatriate such balances, if at all. U.S. GAAP does not permit the establishment of reserves against cash balances, and for this

reason we have not done so. Our inability to convert such balances into U.S. dollars at a favorable exchange rate and to

repatriate them could have a material effect on the results of our operations.

Transactions executed through SICAD I and SICAD II auctions as of September 30, 2014 were at a rate of 12.00 and 49.98

bolivars to one U.S. dollar, respectively. If the Company were to revalue at either the SICAD I or SICAD II rates, the estimated

pre-tax devaluation charge of its net monetary assets as compared to the official exchange rate of 6.30 bolivars to one U.S.

dollar would equal approximately $38 and $69, respectively.

Net sales for Venezuela represented approximately 1.3% of consolidated net sales and Venezuela net income contributed

approximately $0.20 to our total consolidated earnings per diluted share for the year ended September 30, 2014.

Financial Results

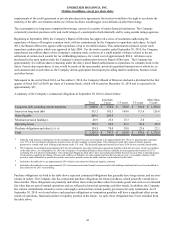

For the year ended September 30, 2014, net earnings were $356.1, or $5.69 per diluted share, compared to net earnings of

$407.0 or $6.47 per diluted share, in fiscal 2013 and $408.9, or $6.22 per diluted share, in fiscal 2012. Total average diluted

shares outstanding were 62.6 million, 62.9 million and 65.7 million for fiscal years 2014, 2013 and 2012, respectively. The

decline in average diluted shares outstanding over the time periods presented was the result of share repurchases.

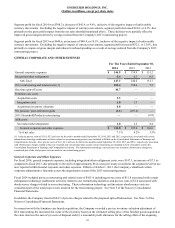

Diluted earnings per share (EPS) for each fiscal year were impacted by certain items related to restructuring, spin-off and other

realignment activities, the impact of the gains resulting from pension and post-retirement benefit changes, costs associated with

the acquisition and integration of acquired businesses, refinancing activities and certain other items as shown in the table below.

The impacts of these items on both reported net earnings and reported net earnings per diluted share are provided below as a

reconciliation of net earnings and net earnings per diluted share to adjusted net earnings and adjusted net earnings per diluted

share, which are non-GAAP measures.

34