Energizer 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

this time, the Company is unable to predict with any degree of certainty how recent and future developments in Venezuela will

affect our Venezuela operations.

For all of fiscal 2014, the Company’s overall results in Venezuela are reflected in the Consolidated Financial Statements at the

official exchange rate equal to 6.30 bolivars per U.S. dollar. During fiscal year 2014, the Company received approximately

$9.5 of payments at the 6.30 per U.S. dollar rate for household and personal care products previously imported in accordance

with Non National Production Certificates (CNP) executed between the Company and the Venezuela government. In addition,

the Company is awaiting payment for an additional $5.6 as of September 30, 2014 (at the 6.30 per U.S. dollar rate) for

household and personal care products imported in accordance with the second CNP executed between the Company and the

Venezuela government.

Depending on the ultimate transparency and liquidity of the SICAD I and II markets, it is possible that in future periods the

Company may need to remeasure a portion or substantially all of its net monetary balances at a rate other than the official

exchange rate of 6.30 currently being used. To the extent that the SICAD I or II rates are higher than the official exchange rate

at the time our net monetary balances are remeasured, this could result in an additional devaluation charge, which could be

material. In addition, operating results translated using a rate higher than the official exchange rate of 6.30 bolivars to one U.S.

dollar would result in a reduction in earnings, which could be material.

At September 30, 2014, the Company had approximately $79 in net monetary assets in Venezuela at the official exchange rate

of 6.30 to one U.S. dollar. However, due to the future uncertainty and volatility of the foreign exchange markets in Venezuela,

we believe that any future remittance of our local currency cash balances from Venezuela would be substantially less than the

amount recorded as of September 30, 2014 on our Consolidated Balance Sheets per U.S. GAAP. As such, we cannot give

assurance as to the exchange rate at which such balances might be converted in the future and/or when we might be able to

repatriate such balances, if at all. U.S. GAAP does not permit the establishment of reserves against cash balances, and for this

reason we have not done so. Our inability to convert such balances into U.S. dollars at a favorable exchange rate and to

repatriate them could have a material effect on the results of our operations.

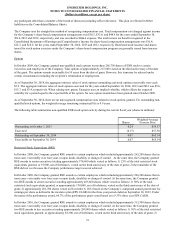

Transactions executed through SICAD I and SICAD II auctions as of September 30, 2014 were at a rate of 12.00 and 49.98

Bolivares Fuertes to one U.S. dollar, respectively. If the Company were to revalue at either the SICAD I and SICAD II rates,

the estimated pre-tax devaluation charge of its net monetary assets as compared to the official exchange rate of 6.30 bolivars to

one U.S. dollar would equal approximately $38 and $69, respectively.

Net sales for Venezuela represented approximately 1.3% of consolidated net sales and Venezuela net income contributed

approximately $0.20 to our total consolidated earnings per diluted share for the year ended September 30, 2014.

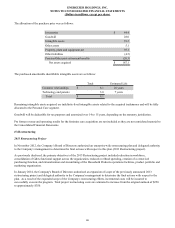

(7) Goodwill and Intangible Assets

Goodwill and intangible assets deemed to have an indefinite life are not amortized, but reviewed annually for impairment of

value or when indicators of a potential impairment are present. As part of our business planning cycle, we performed our

annual impairment testing for our Household Products and Personal Care reporting units in the fourth quarter of fiscal 2014,

2013 and 2012. There were no indications of impairment of goodwill noted during this testing.

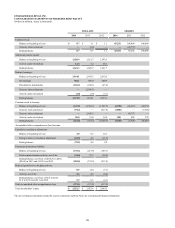

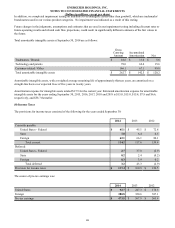

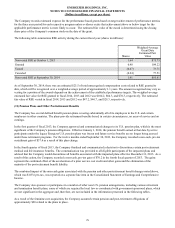

The following table represents the carrying amount of goodwill by segment at September 30, 2014:

Household

Products

Personal

Care Total

Balance at October 1, 2013 $ 37.2 $ 1,438.6 $ 1,475.8

Feminine care acquisition — 28.0 28.0

Cumulative translation adjustment (0.1)(16.3)(16.4)

Balance at September 30, 2014 $ 37.1 $ 1,450.3 $ 1,487.4

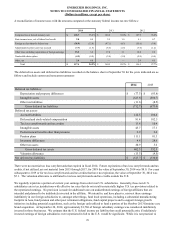

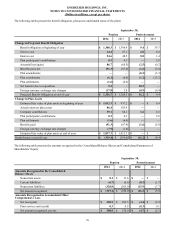

The Company had indefinite-lived intangible assets of $1,727.1 ($1,647.0 in Personal Care and $80.1 in Household Products)

at September 30, 2014 and $1,703.9 at September 30, 2013. The increase of $23.2 is due to the feminine care acquisition of

$30.2 and changes in foreign currency translation rates.

68