Energizer 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

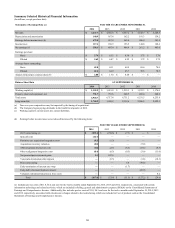

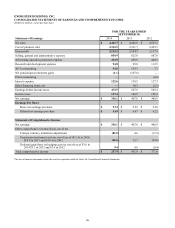

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

quarters of the same and different years due to the seasonality and timing of orders for sun care products as well as the potential

impact of weather patterns on sun care sales and consumption.

Other factors may also have an impact on the timing and amounts of sales, operating income, working capital and cash flows

such as the timing of new product launches by competitors or by the Company; the timing of advertising, promotional,

merchandising or other marketing activities by competitors or by the Company; and the timing of retailer merchandising

decisions and actions.

Other Matters

Environmental Matters

The operations of the Company, like those of other companies, are subject to various federal, state, foreign and local laws and

regulations intended to protect the public health and the environment. These regulations relate primarily to worker safety, air

and water quality, underground fuel storage tanks and waste handling and disposal. The Company has received notices from the

U.S. Environmental Protection Agency, state agencies and/or private parties seeking contribution, that it has been identified as a

“potentially responsible party” (PRP) under the Comprehensive Environmental Response, Compensation and Liability Act, and

may be required to share in the cost of cleanup with respect to eight federal “Superfund” sites. It may also be required to share

in the cost of cleanup with respect to state-designated sites or other sites outside of the U.S.

Accrued environmental costs at September 30, 2014 were $16.9, of which $3.2 is expected to be spent in fiscal 2015. It is

difficult to quantify with certainty the cost of environmental matters, particularly remediation and future capital expenditures

for environmental control equipment. Total environmental capital expenditures and operating expenses are not expected to

have a material effect on our total capital and operating expenditures, consolidated earnings or competitive position. However,

current environmental spending estimates could be modified as a result of changes in our plans or our understanding of

underlying facts, changes in legal requirements, including any requirements related to global climate change, or other factors.

Inflation

Management recognizes that inflationary pressures may have an adverse effect on the Company through higher material, labor

and transportation costs, asset replacement costs and related depreciation, and health care and other costs. In general, the

Company has been able to offset or minimize inflation effects through a variety of methods including pricing actions, cost

reductions and productivity improvements. We can provide no assurance that such mitigation will be available in the future.

Legal and other contingencies

The Company and its subsidiaries are parties to a number of legal proceedings in various jurisdictions arising out of the

operations of the Company's businesses. Many of these legal matters are in preliminary stages and involve complex issues of

law and fact, and may proceed for protracted periods of time. The amount of liability, if any, from these proceedings cannot be

determined with certainty. However, based upon present information, the Company believes that its liability, if any, arising from

such pending legal proceedings, asserted legal claims and known potential legal claims which are likely to be asserted, are not

reasonably likely to be material to the Company's financial position, results of operations, or cash flows, taking into account

established accruals for estimated liabilities.

Critical Accounting Policies

The methods, estimates, and judgments the Company uses in applying its most critical accounting policies have a significant

impact on the results the Company reports in its consolidated financial statements. Specific areas, among others, requiring the

application of management's estimates and judgment include assumptions pertaining to accruals for consumer and trade-

promotion programs, pension and postretirement benefit costs, share-based compensation, future cash flows associated with

impairment testing of goodwill and other long-lived assets, credit worthiness of customers, uncertain tax positions, the

reinvestment of undistributed foreign earnings, tax valuation allowances, and legal and environmental matters. On an ongoing

basis, the Company evaluates its estimates, but actual results could differ materially from those estimates.

The Company's most critical accounting policies are revenue recognition, pension and other postretirement benefits, share-

based compensation, the valuation of long-lived assets (including property, plant and equipment), income taxes (including

uncertain tax positions) and the carrying value of intangible assets (and the related impairment testing of goodwill and other

indefinite-lived intangible assets). The Company's critical accounting policies have been reviewed with the Audit Committee of

the Board of Directors. A summary of the Company's significant accounting policies is contained in Note 2 of the Notes to

Consolidated Financial Statements. This listing is not intended to be a comprehensive list of all of the Company's accounting

policies.

47