Energizer 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

requirements of the credit agreement or private placement note agreements, the lenders would have the right to accelerate the

maturity of the debt. Acceleration under one of these facilities would trigger cross defaults on other borrowings.

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

consistently monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.

Beginning in September 2000, the Company’s Board of Directors has approved a series of resolutions authorizing the

repurchase of shares of Energizer common stock, with no commitments by the Company to repurchase such shares. In April

2012, the Board of Directors approved the repurchase of up to ten million shares. This authorization replaced a prior stock

repurchase authorization, which was approved in July 2006. For the twelve months ended September 30, 2014, the Company

repurchased one million shares of the Company's common stock, exclusive of a small number of shares related to the net

settlement of certain stock awards for tax withholding purposes, for a total cost of approximately $94.4. All shares were

purchased in the open market under the Company's current authorization from its Board of Directors. The Company has

approximately five million shares remaining under the above noted Board authorization to repurchase its common stock in the

future. Future share repurchases, if any, would be made on the open market, privately negotiated transactions or otherwise, in

such amounts and at such times as the Company deems appropriate based upon prevailing market conditions, business needs

and other factors.

Subsequent to the end of fiscal 2014, on November 3, 2014, the Company's Board of Directors declared a dividend for the first

quarter of fiscal 2015 of $0.50 per share of Common Stock, which will be paid on December 16, 2014 and is expected to be

approximately $31.

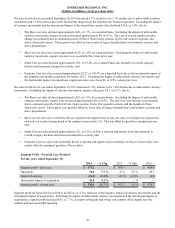

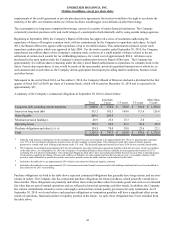

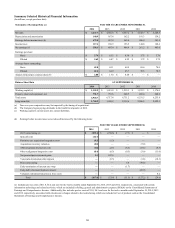

A summary of the Company’s contractual obligations at September 30, 2014 is shown below:

Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Long-term debt, including current maturities $ 2,000.0 $ 230.0 $ 360.0 $ 310.0 $ 1,100.0

Interest on long-term debt 515.3 105.3 169.6 113.6 126.8

Notes Payable 289.5 289.5———

Minimum pension funding(1) 40.9 23.6 15.3 2.0 —

Operating leases 129.3 28.9 41.1 29.4 29.9

Purchase obligations and other(2) (3) (4) 154.5 70.0 38.8 23.6 22.1

Total $ 3,129.5 $ 747.3 $ 624.8 $ 478.6 $ 1,278.8

1Globally, total pension contributions for the Company in the next five years are estimated to be approximately $41. The U.S. pension plans constitute

over 75% of the total benefit obligations and plan assets for the Company’s pension plans. The estimates beyond 2014 represent future pension

payments to comply with local funding requirements in the U.S. only. The projected payments beyond fiscal year 2019 are not currently determinable.

2The Company has estimated approximately $6.8 of cash settlements associated with unrecognized tax benefits within the next year, which are included

in the table above. As of September 30, 2014, the Company’s Consolidated Balance Sheet reflects a liability for unrecognized tax benefits of $37.8,

excluding $13.2 of interest and penalties. The contractual obligations table above does not include this liability beyond one year. Due to the high degree

of uncertainty regarding the timing of future cash outflows of liabilities for unrecognized tax benefits beyond one year, a reasonable estimate of the

period of cash settlement for periods beyond the next twelve months cannot be made, and thus is not included in this table.

3Included in the table above are approximately $59 of fixed costs related to third party logistics contracts.

4Included in the table above are approximately $33 of severance and related benefit costs associated with staffing reductions that have been identified to

date related to the 2013 restructuring.

Purchase obligations set forth in the table above represent contractual obligations that generally have longer terms, and are non-

routine in nature. The Company also has contractual purchase obligations for future purchases, which generally extend one to

three months. These obligations are primarily individual, short-term purchase orders for routine goods and services at estimated

fair value that are part of normal operations and are reflected in historical operating cash flow trends. In addition, the Company

has various commitments related to service and supply contracts that contain penalty provisions for early termination. As of

September 30, 2014, we do not believe such purchase obligations or termination penalties will have a significant effect on our

results of operations, financial position or liquidity position in the future. As such, these obligations have been excluded from

the table above.

44