Energizer 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

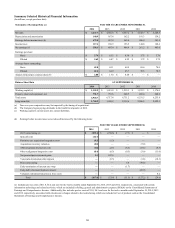

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

more with no other changes in assumptions would only meaningfully impact our assessment of the Playtex and Wet

Ones brands which had carrying values of approximately $650 and $200, respectively, at September 30, 2014.

The recorded value of goodwill and intangible assets from recently acquired businesses are derived from more recent

business operating plans and macroeconomic environmental conditions and, therefore, are likely more susceptible to

an adverse change that could require an impairment charge.

During fiscal 2014, we tested goodwill for impairment for both the Household Products and Personal Care reporting

units. There were no indications of impairment of goodwill noted during this testing. In addition, we completed

impairment testing on indefinite-lived intangible assets other than goodwill, which are trademarks/brand names used in

our various product categories. No impairment was indicated as a result of this testing.

Recently Issued Accounting Standards

There are no new accounting pronouncements issued or effective that had a material impact on our Consolidated Financial

Statements.

On April 10, 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No.

2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity (the revised standard).

The revised standard changes the current guidance and, in many cases, is expected to result in fewer disposals being presented

as discontinued operations. The standard is effective for public companies for annual periods beginning after December 15,

2014 and is to be applied prospectively to all new disposals of components and new classifications as held for sale beginning in

2015 for most entities, with early adoption allowed in 2014. The Company’s first reporting date with the new standard will be

December 31, 2015. We will evaluate the effects of this standard on our financial position, results of operations and cash flows

as applicable.

On May 28, 2014, the FASB issued ASU No. 2104-09, Revenue for Contracts with customers, which provides a single

comprehensive revenue recognition model for all contracts with customers to improve comparability within industries, across

industries, and across capital markets. The standard is effective for public companies for annual and interim periods beginning

after December 15, 2016 and early adoption is not permitted. The Company’s first reporting date with the new standard will be

December 31, 2017. The effects of this standard on our financial position, results of operations and cash flows are not yet

known.

On August 28, 2014, the FASB issued ASU No. 2104-17, Disclosure of Uncertainties about an Entity's Ability to Continue as a

Going Concern, which requires management to assess the Company's ability to continue as a going concern and to provide

related disclosures in certain circumstances. The standard is effective for public companies for annual periods beginning after

December 15, 2016 and early adoption is permitted. The Company’s first reporting date with the new standard will be

September 30, 2017. We will evaluate the effects of this standard on our financial position, results of operations and cash flows

as applicable.

51