Energizer 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

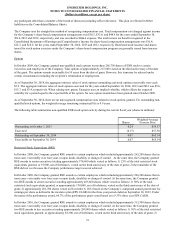

On April 10, 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No.

2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity (the revised standard).

The revised standard changes today’s guidance and, in many cases, is expected to result in fewer disposals being presented as

discontinued operations. The standard is effective for public companies for annual periods beginning after December 15, 2014

and is to be applied prospectively to all new disposals of components and new classifications as held for sale beginning in 2015

for most entities, with early adoption allowed in 2014. The Company’s first reporting date with the new standard will be

December 31, 2015. We will evaluate the effects of this standard on our financial position, results of operations and cash flows

as applicable.

On May 28, 2014, the FASB issued ASU No. 2104-09, Revenue for Contracts with customers, which provides a single

comprehensive revenue recognition model for all contracts with customers to improve comparability within industries, across

industries, and across capital markets. The standard is effective for public companies for annual and interim periods beginning

after December 15, 2016 and early adoption is not permitted. The Company’s first reporting date with the new standard will be

December 31, 2017. The effects of this standard on our financial position, results of operations and cash flows are not yet

known.

On August 28, 2014, the FASB issued ASU No. 2104-17, Disclosure of Uncertainties about an Entity's Ability to Continue as a

Going Concern, which requires management to assess the Company's ability to continue as a going concern and to provide

related disclosures in certain circumstances. The standard is effective for public companies for annual periods beginning after

December 15, 2016 and early adoption is permitted. The Company’s first reporting date with the new standard will be

September 30, 2017. We will evaluate the effects of this standard on our financial position, results of operations and cash flows

as applicable.

(3) Proposed Spin-off Transaction

On April 28, 2014, the Board of Directors authorized management to pursue a plan to spin-off the Company’s Household

Products business and thereby create two independent, publicly traded companies. The spin-off is planned as a tax-free spin-off

to the Company’s shareholders and is expected to be completed by July 1, 2015. The proposed spin-off is subject to further due

diligence as appropriate and customary conditions, including receipt of regulatory approvals, an opinion of counsel regarding

the tax-free nature of the spin-off, the effectiveness of a Form 10 filing with the Securities and Exchange Commission, and

final approval by the Company's Board of Directors.

We expect to file a Form 10 registration statement with the SEC in early calendar 2015.

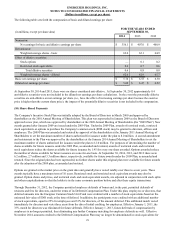

The Company is incurring incremental costs to evaluate, plan and execute the transaction. For the twelve months ended

September 30, 2014, $44.7 of pre-tax charges were incurred and recorded in SG&A on the Consolidated Statements of

Earnings and Comprehensive Income.

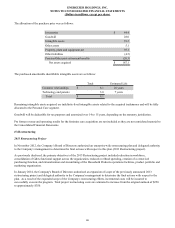

(4) Acquisition of Feminine Care Brands

In October 2013, the Company completed the acquisition of the Stayfree pad, Carefree liner and o.b. tampon feminine care

brands in the U.S., Canada and the Caribbean from Johnson & Johnson for an aggregate cash purchase price of $187.1,

inclusive of a $1.8 working capital adjustment, which was finalized and settled in April 2014. The Company financed the

feminine care acquisition with approximately $135 of available foreign cash and $50 obtained from borrowings under the

Company’s available committed bank facilities. Liabilities assumed as a result of the feminine care acquisition are limited

primarily to certain employee benefit obligations. The Company combined these acquired brands within its existing feminine

care business in the Personal Care segment. Combining these complementary businesses with our existing feminine care

products provides the Company with brands in each of the key feminine hygiene categories. There are no contingent payments,

options or commitments associated with the feminine care acquisition.

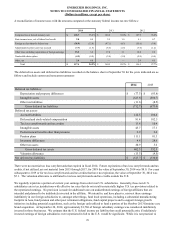

As of March 31, 2014, the purchase price allocation for the feminine care acquisition was complete. We have determined the

fair values of assets acquired and liabilities assumed for purposes of allocating the purchase price, in accordance with

accounting guidance for business combinations. The Company estimated a fair value adjustment for inventory based on the

estimated selling price of the finished goods acquired at the closing date less the sum of (a) costs of disposal and (b) a

reasonable profit allowance for the selling effort of the acquiring entity. The fair value adjustment for the acquired equipment

was established using both a cost and market approach. The fair values of the identifiable intangible assets were estimated

using various valuation methods including discounted cash flows using both an income and cost approach.

64