Energizer 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

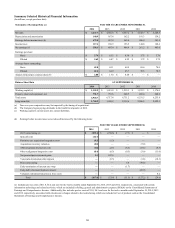

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

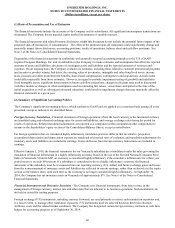

Deferred tax assets generally represent the tax effect of items that can be used as a tax deduction or credit in future

years for which we have already recorded the tax benefit in our income statement. Deferred tax liabilities generally

represent tax expense recognized in our financial statements for which payment has been deferred, the tax effect of

expenditures for which a deduction has already been taken in our tax return but has not yet been recognized in our

financial statements or assets recorded at estimated fair value in business combinations for which there was no

corresponding tax basis adjustment.

We regularly repatriate a portion of current year earnings from select non-U.S. subsidiaries. Generally, these non-U.S.

subsidiaries are in tax jurisdictions with effective tax rates that do not result in materially higher U.S. tax provisions

related to the repatriated earnings. No provision is made for additional taxes on undistributed earnings of foreign

affiliates that are intended and planned to be indefinitely invested in foreign affiliates. We intend to reinvest these

earnings indefinitely in our foreign subsidiaries to fund local operations, fund strategic growth objectives, fund

pension and other postretirement obligations and fund capital projects. See Note 8 of the Notes to Consolidated

Financial Statements for further discussion.

The Company estimates income taxes and the effective income tax rate in each jurisdiction that it operates. This

involves estimating taxable earnings, specific taxable and deductible items, the likelihood of generating sufficient

future taxable income to utilize deferred tax assets, the portion of the income of foreign subsidiaries that is expected to

be remitted to the U.S. and be taxable and possible exposures related to future tax audits. Deferred tax assets are

evaluated on a subsidiary by subsidiary basis to ensure that the asset will be realized. Valuation allowances are

established when the realization is not deemed to be more likely than not. Future performance is monitored, and when

objectively measurable operating trends change, adjustments are made to the valuation allowances accordingly. To the

extent the estimates described above change, adjustments to income taxes are made in the period in which the estimate

is changed.

The Company operates in multiple jurisdictions with complex tax and regulatory environments, which are subject to

differing interpretations by the taxpayer and the taxing authorities. At times, we may take positions that management

believes are supportable, but are potentially subject to successful challenges by the appropriate taxing authority. The

Company evaluates its tax positions and establishes liabilities in accordance with guidance governing accounting for

uncertainty in income taxes. The Company reviews these tax uncertainties in light of the changing facts and

circumstances, such as the progress of tax audits, and adjusts them accordingly.

• Acquisitions, Goodwill and Intangible Assets The Company allocates the cost of an acquired business to the assets

acquired and liabilities assumed based on their estimated fair values at the date of acquisition. The excess value of the

cost of an acquired business over the estimated fair value of the assets acquired and liabilities assumed is recognized as

goodwill. The valuation of the acquired assets and liabilities will impact the determination of future operating results.

The Company uses a variety of information sources to determine the value of acquired assets and liabilities including:

third-party appraisers for the values and lives of property, identifiable intangibles and inventories; actuaries for defined

benefit retirement plans; and legal counsel or other experts to assess the obligations associated with legal,

environmental or other claims.

Significant judgment is required in estimating the fair value of intangible assets and in assigning their respective useful

lives. The fair value estimates are based on historical information and on future expectations and assumptions deemed

reasonable by management, but are inherently uncertain. Determining the useful life of an intangible asset also

requires judgment. Certain brand intangibles are expected to have indefinite lives based on their history and our plans

to continue to support and build the acquired brands. Other intangible assets are expected to have determinable useful

lives. Our assessment of intangible assets that have an indefinite life and those that have a determinable life is based on

a number of factors including the competitive environment, market share, brand history, underlying product life cycles,

operating plans and the macroeconomic environment. Our estimates of the useful lives of determinable-lived

intangible assets are primarily based on the same factors. The costs of determinable-lived intangible assets are

amortized to expense over the estimated useful life. The value of indefinite-lived intangible assets and residual

goodwill is not amortized, but is tested at least annually for impairment. See Note 7 of the Notes to Consolidated

Financial Statements.

However, future changes in the judgments, assumptions and estimates that are used in our impairment testing

including discount rates or future operating results and related cash flow projections, could result in significantly

different estimates of the fair values in the future. An increase in discount rates, a reduction in projected cash flows or

a combination of the two could lead to a reduction in the estimated fair values, which may result in impairment

charges that could materially affect our financial statements in any given year. For purposes of our goodwill and

indefinite-lived intangible assets impairment testing, an increase in our assumed discount rate of 100 basis points or

50