Energizer 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

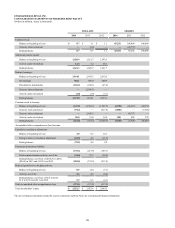

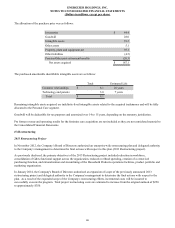

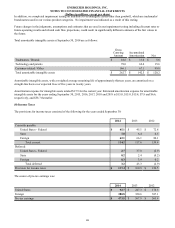

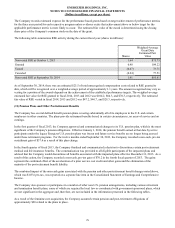

The following table summarizes the 2013 restructuring project activity for the twelve months ended September 30, 2014.

Utilized

October 1,

2013

Charge to

Income

Other

(a) Cash

Non-

Cash

September 30,

2014

Severance & Termination Related Costs $ 16.3 $ 32.6 $ (0.7)$ (26.1) $ — $ 22.1

Accelerated Depreciation — 4.7 — — (4.7)—

Other Costs 4.3 52.9 (0.1)(50.1)(2.7) 4.3

Net loss on asset sale — 2.4 — 4.9 (7.3)—

Total $ 20.6 $ 92.6 $ (0.8)$ (71.3)$ (14.7) $ 26.4

(a) Includes the impact of currency translation.

2011 Household Products Restructuring

For the twelve months ended September 30, 2012, our prior Household Products restructuring activities generated pre-tax

income of $6.8, which was driven by the $13 gain on the sale of our former battery manufacturing facility in Switzerland. This

plant was closed in fiscal 2011. This gain was partially offset by $6 of additional restructuring costs in fiscal 2012. The net

amount is included as a separate line item on the Consolidated Statements of Earnings and Comprehensive Income.

(6) Venezuela

Effective January 1, 2010 and continuing through September 30, 2014, the financial statements for our Venezuela subsidiary

are consolidated under the rules governing the translation of financial information in a highly inflationary economy based on

the use of the blended National Consumer Price Index in Venezuela. Under GAAP, an economy is considered highly

inflationary if the cumulative inflation rate for a three year period meets or exceeds 100 percent. If a subsidiary is considered

to be in a highly inflationary economy, the financial statements of the subsidiary must be re-measured into our reporting

currency (U.S. dollar) and future exchange gains and losses from the re-measurement of monetary assets and liabilities are

reflected in current earnings, rather than exclusively in the equity section of the balance sheet, until such times as the economy

is no longer considered highly inflationary.

On February 13, 2013, the Venezuela government devalued the Bolivar Fuerte relative to the U.S. dollar. The revised official

exchange rate moved from 4.30 bolivars per U.S. dollar to an exchange rate of 6.30 bolivars per U.S. dollar. The Central

Government also suspended the alternate currency market administered by the central bank known as SITME that made U.S.

dollars available at a rate higher than the previous official rate, generally in the range of 5.50 bolivars per U.S. dollar. As a

result of the devaluation noted above and the elimination of the SITME market, the Company revalued its net monetary assets

at March 31, 2013 using the revised official rate of 6.30 bolivars per U.S. dollar. Thus, the Company recorded a devaluation

charge of approximately $6 during the second fiscal quarter of fiscal 2013, due primarily to the devaluation of local currency

cash balances. This charge was included in Other financing items, net on the Consolidated Statements of Earnings and

Comprehensive Income. The official exchange rate is determined and administered by the Cadivi/Cencoex System (the

National Center for International Trade that administers the authorization for the acquisition and the actual payment of foreign

currency conducted for essential imports).

On January 24, 2014, the Venezuelan government issued Exchange Agreement No. 25, which stated the rate of exchange established

in the most recent SICAD I auction will be used for payments related to international investments, royalties and the use and

exploitation of patents, trademarks, licenses, franchises and technology.

On March 10, 2014, the Venezuelan government announced the inception of the SICAD II program as an additional mechanism

to purchase foreign currency. The SICAD II program does not supersede the Cadivi/Cencoex for essential imports (currently at

6.30 bolivars per U.S. dollar) nor SICAD I (equal to 12.00 bolivars per U.S. dollar as of September 30, 2014).

Thus far, the Company has not been invited to participate in the SICAD I auction process nor chosen to utilize the SICAD II

auction system. Whether we will be able to access or participate in either SICAD system in the foreseeable future or what

volume of currency exchange we would be able to transact through these alternative mechanisms is unknown at the present

time. We continue to monitor these situations, including the impact restrictions may have on our future business operations. At

67