Energizer 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

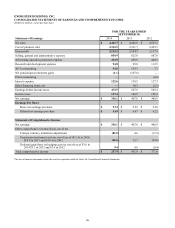

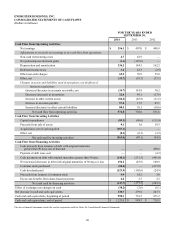

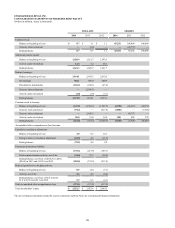

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

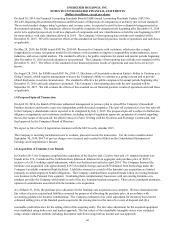

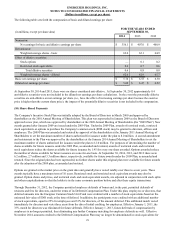

The allocation of the purchase price was as follows:

Inventories $ 44.4

Goodwill 28.0

Intangible assets 39.3

Other assets 5.1

Property, plant and equipment,net 95.1

Other liabilities (4.5)

Pension/Other post-retirement benefits (20.3)

Net assets acquired $ 187.1

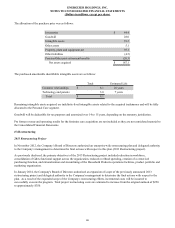

The purchased amortizable identifiable intangible assets are as follows:

Total Estimated Life

Customer relationships $ 6.1 20 years

Technology and patents 3.0 7 years

Total $ 9.1

Remaining intangible assets acquired are indefinite-lived intangible assets related to the acquired tradenames and will be fully

allocated to the Personal Care segment.

Goodwill will be deductible for tax purposes and amortized over 14 to 15 years, depending on the statutory jurisdiction.

Pro forma revenue and operating results for the feminine care acquisition are not included as they are not considered material to

the Consolidated Financial Statements.

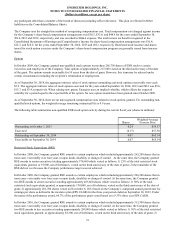

(5) Restructuring

2013 Restructuring Project

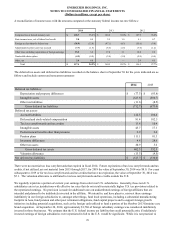

In November 2012, the Company’s Board of Directors authorized an enterprise-wide restructuring plan and delegated authority

to the Company’s management to determine the final actions with respect to this plan (2013 Restructuring project).

As previously disclosed, the primary objectives of the 2013 Restructuring project included reduction in workforce,

consolidation of G&A functional support across the organization, reduced overhead spending, creation of a center-led

purchasing function, and rationalization and streamlining of the Household Products operations facilities, product portfolio and

marketing organization.

In January 2014, the Company's Board of Directors authorized an expansion of scope of the previously announced 2013

restructuring project and delegated authority to the Company's management to determine the final actions with respect to the

plan. As a result of the expanded scope of the Company's restructuring efforts, incremental costs will be incurred to

successfully execute the program. Total project restructuring costs are estimated to increase from the original outlook of $250

to approximately $350.

65