Energizer 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2014 was a successful and transformative year for

Energizer Holdings. We met a number of challenges head-on and

achieved a third consecutive year of record adjusted earnings per

share – delivering a three year compounded annual growth rate

of 12 percent. We also set into motion comprehensive action

plans to create additional shareholder value by separating into

two strong and successful stand-alone companies.

I am proud of Energizer and our colleagues for what was

accomplished this past year. I am even more excited for our

customers and shareholders for the opportunities ahead.

Through innovation, we simplify and enhance the lives of

customers and consumers. Every day our family of brands

connects with households around the world.

As we approached scal 2014, we knew our businesses would

be tested by several headwinds. We continued to operate in a

hypercompetitive environment while contending with a consumer-

spending environment that has yet to fully recover. In addition,

we realized the majority of the impact of the shelf space lost at

two major Household Products customers in the previous year.

And nally, economies around the world remained weak and

currency uctuations adversely affected the bottom line.

Yet, in this environment, we realized record adjusted earnings

per share of $7.32, an increase over the year before of more than

5 percent. In addition, gross margin improved by 90 basis points.

We delivered these results while increasing Advertising &

Promotion support for our brands, up $53 million or 130 basis

points as a percent of net sales. At the same time, we kept a tight

rein on SG&A expense, which decreased 50 basis points* as a

percent of net sales. We continued to execute our restructuring

program to identify cost savings in both the Household Products

and Personal Care businesses and made great progress on our

working capital reduction initiative. At the same time, we

strengthened our Personal Care portfolio with the strategic

acquisition of Johnson & Johnson’s Stayfree, Carefree and o.b.

feminine care business, which added $0.45 to our adjusted

earnings per share in scal 2014, exceeding our expectations.

RESTRUCTURING PROGRAM

Our restructuring program continues to deliver meaningful savings,

with approximately $255 million in savings realized since the

inception of the project in 2012. We are on track to deliver

$300 million in savings by July 1, 2015, the expected date for

separating into two stand-alone companies. Our original target

was $200 million, but we are now estimating total project savings

of $330 million, a portion of which will be achieved following

July 1, 2015. Looking ahead, this focus on cost savings has been

ingrained in our culture and will serve Household Products and

Personal Care well after they split into two companies.

WORKING CAPITAL INITIATIVE

Maximizing free cash ow is critical to any business, providing

nancial exibility and enabling us to return cash to shareholders,

reduce debt levels and invest in the business. In scal 2014,

free cash ow was $487 million. We also reduced working capital

as a percentage of net sales by 790 basis points since the

baseline of scal 2011, which further contributed to an

approximately $350 million reduction in average managed

working capital.

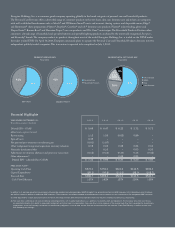

FISCAL 2014 SEGMENT RESULTS

Personal Care Organic sales declined 1.4 percent for the year,

primarily attributable to the ongoing sluggish economic

environment. Category performance improved in the fourth quarter

versus recent trends, but even so, still trailed prior-year levels.

Segment prot for scal 2014 was up nearly 12 percent to $531

million including approximately $25 million of unfavorable currency

uctuations. This increase was driven by the incremental

impact of the acquisition of the Stayfree, Carefree and o.b.

brands and improved margins primarily resulting from our

2013 restructuring program.

Household Products Segment prot decreased 9.6 percent to

$398 million, as organic sales declined more than 7 percent,

mainly reecting the loss of two major customer accounts.

The impact of the loss of the two accounts was annualized in the

fourth quarter. The impact from lower net sales and approximately

$25 million of unfavorable currency uctuations were partially

offset by improved margins primarily resulting from our 2013

restructuring project.

SEPARATION

The Energizer Board of Directors and management team

have continually explored opportunities to improve performance

and increase long-term shareholder value. We have taken

meaningful steps to enhance shareholder value over the last

three years including the restructuring program, working

capital initiative, initiation of a dividend and opportunistic

share repurchases. These efforts also include investments

that have built two successful businesses in Household

Products and Personal Care. Our initiatives were designed

to position each company to compete, grow and create value

for all stakeholders.

Having successfully grown the Personal Care business to

more than $2.6 billion in sales, we knew the time was right

to launch two strong consumer goods companies. This separation

underscores our long-term commitment to driving shareholder

value. We believe there are several benets to creating two

public companies, as each business should be able to:

To Our Shareholders,

ENERGIZER HOLDINGS, INC. 2014 ANNUAL REPORT

PAGE 1

*excludes acquisitions, integration, spin-off transaction and restructuring related charges.