Energizer 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

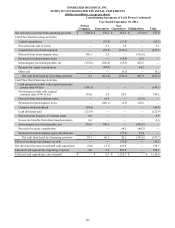

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

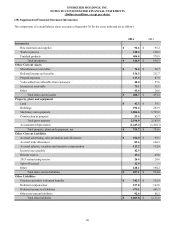

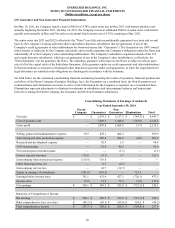

Consolidating Balance Sheets (Condensed)

September 30, 2013

Parent

Company Guarantors

Non-

Guarantors Eliminations Total

Assets

Current Assets

Cash and cash equivalents $ 8.0 $ 8.4 $ 981.9 $ — $ 998.3

Trade receivables, net (a) — 11.8 468.8 — 480.6

Inventories — 334.7 312.7 (31.1) 616.3

Other current assets 23.5 270.5 194.7 (15.5) 473.2

Total current assets 31.5 625.4 1,958.1 (46.6) 2,568.4

Investment in subsidiaries 7,007.5 1,920.7 — (8,928.2)—

Intercompany receivables, net (b) — 4,258.8 260.1 (4,518.9)—

Intercompany notes receivable (b) 2,180.3 4.5 — (2,184.8)—

Property, plant and equipment, net — 474.7 280.9 — 755.6

Goodwill — 1,104.9 370.9 — 1,475.8

Other intangible assets, net — 1,629.5 206.0 — 1,835.5

Other noncurrent assets 10.2 13.4 58.5 — 82.1

Total assets 9,229.5 10,031.9 3,134.5 (15,678.5) 6,717.4

Current liabilities 184.4 421.3 572.5 (24.8) 1,153.4

Intercompany payables, net (b) 4,518.9 — — (4,518.9)—

Intercompany notes payable (b) — 2,180.3 4.5 (2,184.8)—

Long-term debt 1,998.8———1,998.8

Other noncurrent liabilities 73.8 839.6 198.2 — 1,111.6

Total liabilities 6,775.9 3,441.2 775.2 (6,728.5) 4,263.8

Total shareholders' equity 2,453.6 6,590.7 2,359.3 (8,950.0) 2,453.6

Total liabilities and shareholders' equity $ 9,229.5 $ 10,031.9 $ 3,134.5 $ (15,678.5) $ 6,717.4

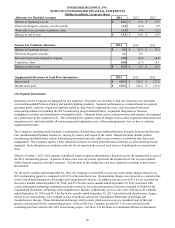

(a) Trade receivables, net for the Non-Guarantors includes approximately $221.4 at September 30, 2013 of U.S. trade receivables sold from

the Guarantors to Energizer Receivables Funding Corp ("ERF"), a 100% owned, special purpose subsidiary, which is a non-guarantor of the

Notes. These receivables are used by ERF to securitize the borrowings under the Company's receivable securitization facility. The trade

receivables are short-term in nature (on average less than 90 days). As payment of the receivable obligation is received from the customer,

ERF remits the cash to the Guarantors in payment for the purchase of the receivables. Cost and expenses paid by ERF related to the

receivable securitization facility are re-billed to the Guarantors by way of intercompany services fees.

(b) Intercompany activity includes notes that bear interest due from the Guarantors to the Parent Company. Interest rates on these notes

approximate the interest rates paid by the Parent on third party debt. Additionally, other intercompany activities include product purchases

between Guarantors and Non-Guarantors, charges for services provided by the parent and various subsidiaries to other affiliates within the

consolidated entity and other intercompany activities in the normal course of business.

99