Energizer 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

In addition, we completed impairment testing on indefinite-lived intangible assets other than goodwill, which are trademarks/

brand names used in our various product categories. No impairment was indicated as a result of this testing.

Future changes in the judgments, assumptions and estimates that are used in our impairment testing including discount rates or

future operating results and related cash flow projections, could result in significantly different estimates of the fair values in

the future.

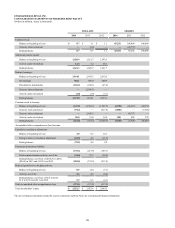

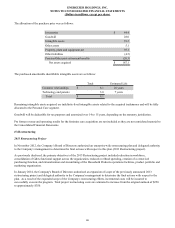

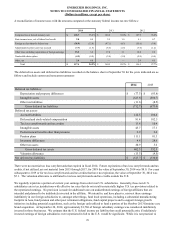

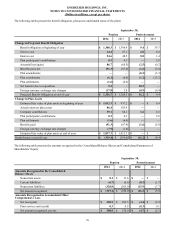

Total amortizable intangible assets at September 30, 2014 are as follows:

Gross

Carrying

Amount

Accumulated

Amortization Net

Tradenames / Brands $ 18.6 $ 13.0 $ 5.6

Technology and patents 78.0 62.4 15.6

Customer-related / Other 166.1 67.1 99.0

Total amortizable intangible assets $ 262.7 $ 142.5 $ 120.2

Amortizable intangible assets, with a weighted average remaining life of approximately thirteen years, are amortized on a

straight-line basis over expected lives of five years to twenty years.

Amortization expense for intangible assets totaled $17.9 for the current year. Estimated amortization expense for amortizable

intangible assets for the years ending September 30, 2015, 2016, 2017, 2018 and 2019 is $15.8, $15.8, $15.4, $7.9 and $6.6,

respectively, and $58.7 thereafter.

(8) Income Taxes

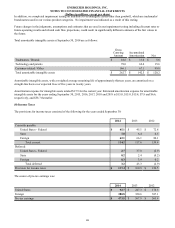

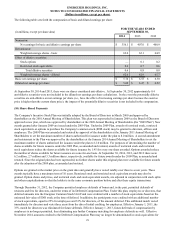

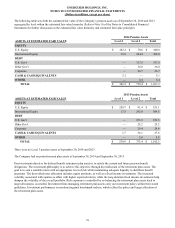

The provisions for income taxes consisted of the following for the years ended September 30:

2014 2013 2012

Currently payable:

United States - Federal $ 45.1 $ 45.1 $ 72.8

State 7.0 6.4 6.5

Foreign 62.1 66.1 80.1

Total current 114.2 117.6 159.4

Deferred:

United States - Federal 2.7 37.0 (2.9)

State 0.2 2.4 (0.2)

Foreign 0.3 3.9 0.2

Total deferred 3.2 43.3 (2.9)

Provision for income taxes $ 117.4 $ 160.9 $ 156.5

The source of pre-tax earnings was:

2014 2013 2012

United States $ 92.7 $ 247.3 $ 178.3

Foreign 380.8 320.6 387.1

Pre-tax earnings $ 473.5 $ 567.9 $ 565.4

69