Energizer 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

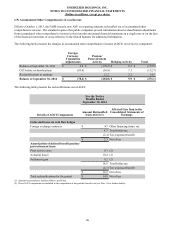

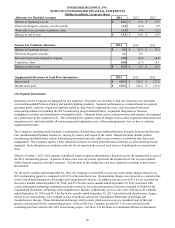

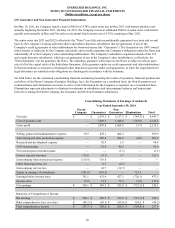

(19) Accumulated Other Comprehensive (Loss)/Income

Effective October 1, 2013, the FASB issued a new ASU on reporting amounts reclassified out of accumulated other

comprehensive income. The standard requires that public companies present information about reclassification adjustments

from accumulated other comprehensive income in their interim and annual financial statements in a single note or on the face

of the financial statements or cross reference to the related footnote for additional information.

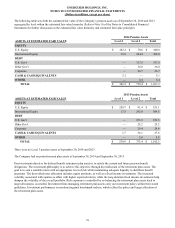

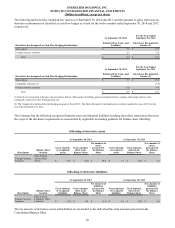

The following table presents the changes in accumulated other comprehensive income (AOCI), net of tax by component:

Foreign

Currency

Translation

Adjustments

Pension/

Postretirement

Activity Hedging Activity Total

Balance at September 30, 2013 $ 4.8 $ (178.2) $ 0.5 $ (172.9)

OCI before reclassifications (83.0) (36.8) 7.1 (112.7)

Reclassifications to earnings — 12.2 2.3 14.5

Balance at September 30, 2014 $ (78.2) $ (202.8) $ 9.9 $ (271.1)

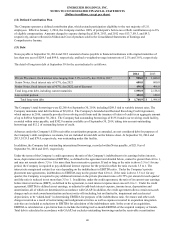

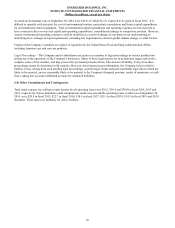

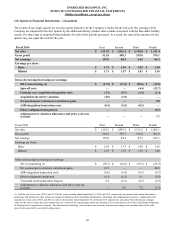

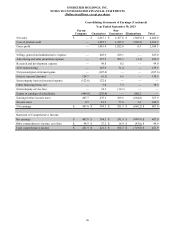

The following table presents the reclassifications out of AOCI:

For the Twelve

Months Ended

September 30, 2014

Details of AOCI Components

Amount Reclassified

from AOCI (1)

Affected Line Item in the

Consolidated Statements of

Earnings

Gains and losses on cash flow hedges

Foreign exchange contracts $ 4.7 Other financing items, net

4.7 Total before tax

(2.4) Tax (expense)/benefit

$ 2.3 Net of tax

Amortization of defined benefit pension/

postretirement items

Prior service costs 0.3 (2)

Actuarial losses 18.4 (2)

Settlement gain 0.2 (2)

18.9 Total before tax

(6.7) Tax (expense)/benefit

$ 12.2 Net of tax

Total reclassifications for the period $ 14.5 Net of tax

(1) Amounts in parentheses indicate debits to profit/loss.

(2) These AOCI components are included in the computation of net periodic benefit cost (see Note 11 for further details).

88