Energizer 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

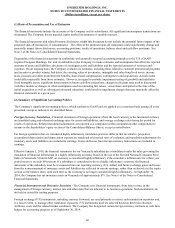

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

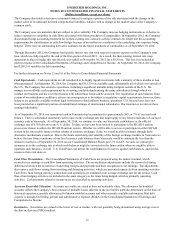

In connection with the feminine care brands acquisition, the Company recorded an increase in the estimated fair value of

inventory acquired of $8.0, to bring the carrying value of the inventory purchased to an amount which approximated the

estimated selling price of the finished goods on hand at the acquisition closing date less the sum of (a) costs to sell and

distribute and (b) a reasonable profit allowance for these efforts by the acquiring entity. As the inventory was sold during the

first and second quarter of fiscal 2014 the adjustments were charged to Cost of products sold in those respective periods.

Capitalized Software Costs – Capitalized software costs are included in other assets. These costs are amortized using the

straight-line method over periods of related benefit ranging from three to seven years. Expenditures related to capitalized

software are included in the Capital expenditures caption in the Consolidated Statements of Cash Flows. Amortization expense

was $2.5, $2.0, and $2.7 in fiscal 2014, 2013 and 2012, respectively.

Property, Plant and Equipment, net – Property, plant and equipment, net is stated at historical costs. Property, plant and

equipment acquired as part of a business combination is recorded at estimated fair value. Expenditures for new facilities and

expenditures that substantially increase the useful life of property, including interest during construction, are capitalized and

reported in the Capital expenditures caption in the accompanying Consolidated Statements of Cash Flows. Maintenance, repairs

and minor renewals are expensed as incurred. When property is retired or otherwise disposed of, the related cost and

accumulated depreciation are removed from the accounts, and gains or losses on the disposition are reflected in earnings.

Depreciation is generally provided on the straight-line basis by charges to pre-tax earnings at rates based on estimated useful

lives. Estimated useful lives range from two to 25 years for machinery and equipment and three to 30 years for buildings and

building improvements. Depreciation expense was $120.3 in fiscal 2014, including accelerated depreciation charges of $4.7

related to our restructuring project. Depreciation expense was $164.7 in 2013, including non-cash asset impairment charges of

$19.3 and accelerated depreciation charges of $23.6, collectively $42.9, related primarily to certain manufacturing assets

including property, plant and equipment located at the facilities to be closed or streamlined, and $136.7 in 2012. See Note 5 of

the Notes to Consolidated Financial Statements for further information on the 2013 restructuring project.

Estimated useful lives are periodically reviewed and, when appropriate, changes are made prospectively. When certain events

or changes in operating conditions occur, asset lives may be adjusted and an impairment assessment may be performed on the

recoverability of the carrying amounts.

Goodwill and Other Intangible Assets – Goodwill and indefinite-lived intangibles are not amortized, but are evaluated annually

for impairment as part of the Company's annual business planning cycle in the fourth fiscal quarter, or when indicators of a

potential impairment are present. The estimated fair value of each reporting unit (Household Products and Personal Care) is

estimated using valuation models that incorporate assumptions and projections of expected future cash flows and operating

plans. Intangible assets with finite lives, and a remaining weighted average life of approximately thirteen years, are amortized

on a straight-line basis over expected lives of five years to twenty years. Such intangibles are also evaluated for impairment

including ongoing monitoring of potential impairment indicators.

Impairment of Long-Lived Assets – The Company reviews long-lived assets, other than goodwill and other intangible assets

for impairment, when events or changes in business circumstances indicate that the remaining useful life may warrant revision

or that the carrying amount of the long-lived asset may not be fully recoverable. The Company performs undiscounted cash

flow analysis to determine if impairment exists. If impairment is determined to exist, any related impairment loss is calculated

based on estimated fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be

received, less cost of disposal.

In November 2012, the Company's Board of Directors authorized an enterprise-wide restructuring plan, which included the

closure of certain Company facilities in fiscal 2013 and 2014. In January 2014, the Company's Board of Directors authorized

an expansion of scope of the previously announced 2013 restructuring project. The Company recorded non-cash asset

impairment charges of $19.3 for the twelve months ended September 30, 2013 related primarily to certain manufacturing assets

including property, plant and equipment located at the facilities to be closed or streamlined. We do not believe our restructuring

plan is likely to result in the impairment of any other material long-lived assets, other than this identified property, plant and

equipment. See Note 5 of the Notes to Consolidated Financial Statements.

Revenue Recognition – The Company's revenue is from the sale of its products. Revenue is recognized when title, ownership

and risk of loss pass to the customer. Discounts are offered to customers for early payment and an estimate of the discounts is

recorded as a reduction of net sales in the same period as the sale. Our standard sales terms are final and returns or exchanges

are not permitted unless a special exception is made; reserves are established and recorded in cases where the right of return

does exist for a particular sale.

62