Energizer 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

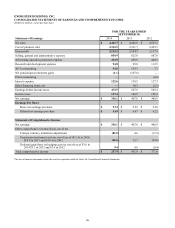

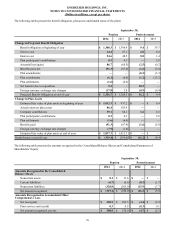

For the twelve months ended September 30, 2014 and 2013, the Company recorded pre-tax expense related to the 2013

restructuring project. The Company does not include the 2013 restructuring project costs in the results of its reportable

segments. The estimated impact of allocating such charges to segment results would have been as follows:

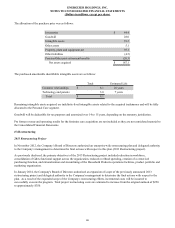

Twelve Months Ended September 30, 2014

Personal

Care

Household

Products Corporate Total

Severance and related benefit costs $ 20.7 $ 11.1 $ 0.8 $ 32.6

Accelerated depreciation 0.6 4.1 — 4.7

Consulting, program management and other exit costs 26.9 25.1 0.9 52.9

Net loss on asset sale — 2.4 — 2.4

Total $ 48.2 $ 42.7 $ 1.7 $ 92.6

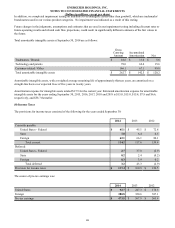

Twelve Months Ended September 30, 2013

Personal

Care

Household

Products Corporate Total

Severance and related benefit costs $ 6.0 $ 42.3 $ 1.0 $ 49.3

Non-cash asset impairment — 19.3 — 19.3

Accelerated depreciation — 23.6 — 23.6

Consulting, program management and other exit costs 9.0 36.1 2.0 47.1

Total $ 15.0 $ 121.3 $ 3.0 $ 139.3

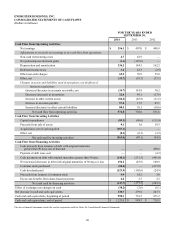

The 2013 restructuring costs are reported on a separate line in the Consolidated Statements of Earnings and Comprehensive

Income. In addition, pre-tax costs of $11.8 and $5.2 for the twelve months ended September 30, 2014 and 2013, respectively,

associated with certain information technology enablement activities related to our restructuring initiatives were included in

SG&A on the Consolidated Statements of Earnings and Comprehensive Income. Also, pre-tax costs of $1.0 and $6.1, for the

twelve months ended September 30, 2014 and 2013, associated with obsolescence charges related to the exit of certain non-

core product lines as part of our restructuring are included in Cost of products sold on the Consolidated Statements of Earnings

and Comprehensive Income. The information technology costs and non-core inventory obsolescence charges are considered

part of the total project costs incurred for our restructuring project. In fiscal 2012 the Company recorded $7.3 of costs

associated with consulting activities related to the 2013 restructuring project.

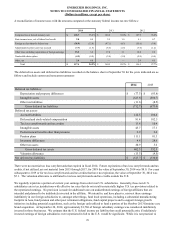

Total project-to-date costs associated with the 2013 restructuring project are approximately $260, of which, approximately $48

relates to non-cash asset impairment and accelerated depreciation charges, approximately $82 relates to severance and related

benefit costs, and approximately $132 relates to consulting, program management and other exit costs. Consulting, program

management and other exit costs are inclusive of approximately $17 in certain information technology enablement costs

(included in SG&A) and approximately $7 in obsolescence charges (included in Cost of products sold), both of which are

considered part of the overall restructuring project.

Pre-tax restructuring costs for the total project are estimated to be $350.

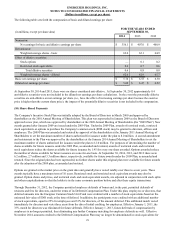

A summary of the estimated remaining costs for the 2013 restructuring is as follows. Totals, as well as category ranges, are

estimates.

• Approximately $5-$10 related to plant closure and accelerated depreciation charges,

• Approximately $30-$40 related to severance and related benefit costs,

• Approximately $5-$10 related to consulting and program management, and

• Approximately $30-$35 related to other restructuring related costs.

66