Energizer 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

program. EBIT is calculated in a fashion identical to EBITDA except that depreciation and amortization are not “added-back”.

Total interest expense is calculated in accordance with GAAP.

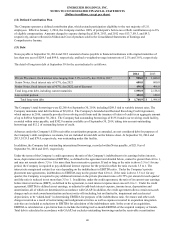

The Company’s ratio of indebtedness to its EBITDA was 2.7 to 1, and the ratio of its EBIT to total interest expense was 5.3 to

1, as of September 30, 2014. In addition to the financial covenants described above, the credit agreements and the note purchase

agreements contain customary representations and affirmative and negative covenants, including limitations on liens, sales of

assets, subsidiary indebtedness, mergers and similar transactions, changes in the nature of the business of the Company and

transactions with affiliates. If the Company fails to comply with the financial covenants referred to above or with other

requirements of the credit agreement or private placement note agreements, the lenders would have the right to accelerate the

maturity of the debt. Acceleration under one of these facilities would trigger cross defaults on other borrowings.

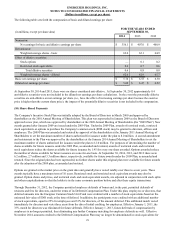

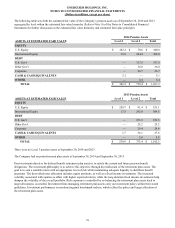

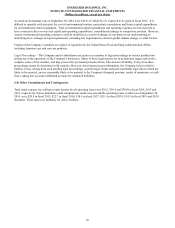

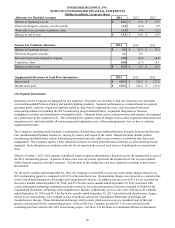

Aggregate maturities of long-term debt, including current maturities, at September 30, 2014 are as follows for the fiscal years’

noted: $230.0 in 2015, $210.0 in 2016, $150.0 in 2017, $310.0 in 2018, zero in 2019 and $1,100.0 thereafter. At this time, the

Company intends to repay scheduled debt maturities over the course of the next fiscal year.

At September 30, 2014, substantially all of the Company's cash balances were located outside the U.S. Given our extensive

international operations, a significant portion of our cash is denominated in foreign currencies. We manage our worldwide cash

requirements by reviewing available funds among the many subsidiaries through which we conduct our business and the cost

effectiveness with which those funds can be accessed. The repatriation of cash balances from certain of our subsidiaries could

have adverse tax consequences or be subject to regulatory capital requirements; however, those balances are generally available

without legal restrictions to fund ordinary business operations. U.S. income taxes have not been provided on certain

undistributed earnings of international subsidiaries. Our intention is to reinvest these earnings outside the U.S. indefinitely.

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

consistently monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.

(14) Preferred Stock

The Company’s Articles of Incorporation authorize the Company to issue up to 10 million shares of $0.01 par value of

preferred stock. During the three years ended September 30, 2014, there were no shares of preferred stock outstanding.

81