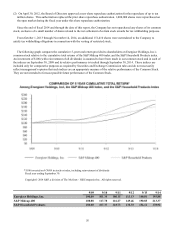

Energizer 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

• The impact of legislative or regulatory determinations or changes by federal, state and local, and foreign authorities,

including taxing authorities.

In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of

any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. The risk factors set

forth in this Annual Report on Form 10-K, in the section entitled "Risk Factors," could affect future results, causing our results

to differ materially from those expressed in our forward-looking statements.

All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and

uncertainties include those detailed from time to time in Energizer’s publicly filed documents.

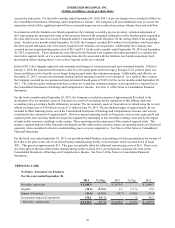

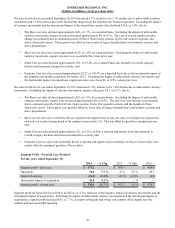

Non-GAAP Financial Measures

While Energizer Holdings, Inc. reports financial results in accordance with accounting principles generally accepted in the U.S.

("GAAP"), this discussion includes certain non-GAAP financial measures. These non-GAAP measures, such as adjusted net

earnings and adjusted net earnings per diluted share, which exclude such items as the costs associated with restructuring

activities, spin-off related costs, acquisition and integration charges, the impact of gains resulting from changes in pension and

post-retirement benefits, the devaluation of the Venezuela Bolivar Fuerte, certain tax items including adjustments to prior years'

tax accruals and certain other items as outlined in the table below are not in accordance with, nor are they a substitute for,

GAAP measures. In addition, other non-GAAP comparatives in this discussion include operating results, organic sales, gross

margin and other comparison changes, excluding the impact of changes in foreign currency rates on a period over period basis

versus the U.S. dollar. The Company believes these non-GAAP measures (which are accompanied by reconciliations to the

comparable GAAP measures) provide a meaningful comparison to the corresponding reported period and assist investors in

performing their analysis. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to,

the comparable GAAP measures. Further, these non-GAAP measures may differ from similarly titled measures presented by

other companies.

Company Overview

General

Energizer Holdings, Inc., incorporated in Missouri in 1999, is one of the world’s largest manufacturers and marketers of

primary batteries, portable lighting and personal care products in the wet shave, skin care, feminine care and infant care product

categories. On April 1, 2000, all of the outstanding shares of common stock of Energizer were distributed in a tax-free spin-off

to shareholders of Ralston Purina Company. The Company employed approximately 12,500 colleagues globally at September

30, 2014 and had fiscal 2014 net sales of $4,447.7. The Company manufactures and/or packages products in more than a dozen

countries and sells products throughout the world.

Operations for the Company are managed via two segments - Personal Care (wet shave, skin care, feminine care and infant care

products) and Household Products (battery and portable lighting products).

The Company's two divisions have distinct priorities to deliver their strategic objectives. Personal Care is focused on

maximizing sales and profit growth through innovation, product line extensions and share gains. Household Products is

focused on stabilizing profitability in a challenging and declining battery category to deliver strong cash flows from its core

battery and portable lights portfolio by building market share through distribution and investment in effective category

fundamentals, driving consumer-led marketing innovation and optimizing its global cost structure. Both divisions continue to

target improved working capital management as a key business objective.

Personal Care includes wet shave products sold under the Schick, Wilkinson Sword, Edge, Skintimate and Personna brands as

well as value-priced private label razors, skin care products sold under the Banana Boat, Hawaiian Tropic, Wet Ones and

Playtex brands, feminine care products sold under the Playtex brand, and the recently acquired Stayfree, Carefree and o.b.

brands in the U.S., Canada and the Caribbean, which were acquired by the Company from Johnson & Johnson in October 2013,

which is the Company's first fiscal quarter of 2014, and infant care products sold under the Playtex and Diaper Genie brands.

We manufacture and distribute Schick and Wilkinson Sword razor systems (SWS), composed of razor handles and refillable

blades, and disposable shave products for men and women. SWS's primary markets are the U.S., Japan and the larger countries

of Western Europe. We believe SWS holds the #2 global market share position in wet shaving. We also believe that Edge and

Skintimate, which are part of our wet shave portfolio, are U.S. market leading brands in shave preparation products, including

shaving gels and creams.

30