Energizer 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

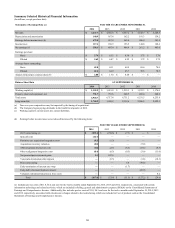

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

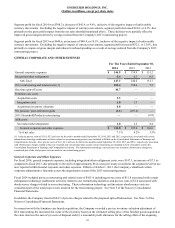

entity. For the twelve months ended September 30, 2014, the Company recorded $8.0 within Cost of products sold based upon

the write-up and subsequent sale of inventory acquired in the feminine care acquisition. Additionally, the Company also

recorded pre-tax acquisition/integration costs of $9.5 for the twelve months ended September 30, 2014. See Note 4 of the

Notes to Consolidated Financial Statements.

For fiscal 2013, general corporate expenses, including integration/other realignment costs, were $140.2, a decrease of $11.5 as

compared to fiscal 2012, due primarily to lower compensation-related costs including lower stock award amortization and

lower corporate overhead due, in part, to our 2013 restructuring project.

Fiscal 2013 included pre-tax restructuring and related costs of $150.6, which were partially offset by cumulative gains of

$107.6 associated with changes to certain pension and post-retirement benefits.

Liquidity and Capital Resources

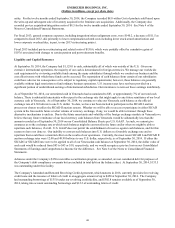

At September 30, 2014, the Company had $1,129.0 in cash, substantially all of which was outside of the U.S. Given our

extensive international operations, the majority of our cash is denominated in foreign currencies. We manage our worldwide

cash requirements by reviewing available funds among the many subsidiaries through which we conduct our business and the

cost effectiveness with which those funds can be accessed. The repatriation of cash balances from certain of our subsidiaries

could have adverse tax consequences or be subject to regulatory capital requirements; however, those balances are generally

available without legal restrictions to fund ordinary business operations. U.S. income taxes have not been provided on a

significant portion of undistributed earnings of international subsidiaries. Our intention is to reinvest these earnings indefinitely.

As of September 30, 2014, our unremitted cash in Venezuela had accumulated to $83, or approximately 7% of our total cash

balance. There is substantial uncertainty with respect to the exchange rate that might apply to any future remittance of our local

currency cash in Venezuela. As of September 30, 2014, we continue to value our Venezuela cash balance at the official

exchange rate of 6.30 bolivars to one U.S. dollar. To date, we have not been invited to participate in the SICAD I auction

process nor chosen to utilize the SICAD II auction system. Whether we will be able to access or participate in either SICAD

system in the foreseeable future or what volume of currency exchange, if any, we would be able to transact through these

alternative mechanisms is unclear. Due to the future uncertainty and volatility of the foreign exchange markets in Venezuela we

believe that any future remittance of our local currency cash balances from Venezuela would be substantially less than the

amount recorded as of September 30, 2014 on our Consolidated Balance Sheets per U.S. GAAP. As such, we cannot give

assurance as to the exchange rate at which such balances might be converted in the future and/or when we might be able to

repatriate such balances, if at all. U.S. GAAP does not permit the establishment of reserves against cash balances, and for this

reason we have not done so. Our inability to convert such balances into U.S. dollars at a favorable exchange rate and to

repatriate them could have a material effect on the results of our operations. Currently, the most recent SICAD I and SICAD II

auction exchange rates were 12.00 and 49.98 bolivars to one U.S. dollar, respectively, as of September 30, 2014. If either the

SICAD I or SICAD II rate were to be applied to all of our Venezuelan cash balances at September 30, 2014, the dollar value of

such cash would be reduced from $83 to $43 or $10, respectively, and we would recognize a pre-tax loss on our Consolidated

Statements of Earnings and Comprehensive Income for the difference. See Note 6 of the Notes to Consolidated Financial

Statements.

Advances under the Company's $150 receivables securitization program, as amended, are not considered debt for purposes of

the Company’s debt compliance covenants but are included in total debt on the balance sheet. At September 30, 2014, $133.5

was outstanding under this facility.

The Company's Amended and Restated Revolving Credit Agreement, which matures in 2016, currently provides for revolving

credit loans and the issuance of letters of credit in an aggregate amount of up to $450 at September 30, 2014. The Company

had outstanding borrowings of $135.0 under our revolving credit facility, and $302.8 remains available as of September 30,

2014, taking into account outstanding borrowings and $12.2 of outstanding letters of credit.

42