Energizer 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

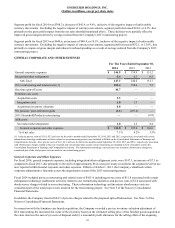

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

Pension and Post-Retirement Benefit Changes

In the first fiscal quarter of 2013, the Company approved and communicated changes to its U.S. pension plan, which is the most

significant of the Company's pension obligations. Effective January 1, 2014, the pension benefit earned to date by active

participants under the legacy Energizer U.S. pension plans was frozen and future service benefits are no longer being accrued

under this retirement program. As a result of this plan change, the Company recorded a pre-tax curtailment gain of $37.4 in the

first fiscal quarter of 2013.

In July 2013, the Company finalized and communicated a decision to discontinue certain post-retirement benefits. The

communication was provided to all eligible participants of the impacted plans in late July 2013. The communication advised the

impacted participants that the Company would discontinue all benefits associated with the impacted plans effective December

31, 2013. As a result of this action, the Company recorded a gain of approximately $70 in the fourth fiscal quarter of 2013.

Collectively, the non-cash pension and post-retirement gains totaled approximately $108, pre-tax, for fiscal 2013, and were

included on a separate line item in the Consolidated Statements of Earnings and Comprehensive Income.

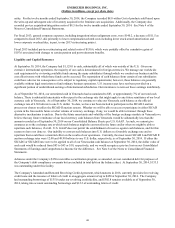

Proposed Spin-off Transaction

On April 28, 2014, the Board of Directors authorized management to pursue a plan to separate the Company’s Household

Products and Personal Care divisions into two independent, publicly traded companies. The spin-off is planned as a tax-free

spin-off to the Company’s shareholders and is expected to be completed by July 1, 2015. The proposed spin-off is subject to

further due diligence as appropriate and customary conditions, including receipt of regulatory approvals, an opinion of counsel

regarding the tax-free nature of the spin-off, the effectiveness of a Form 10 filing with the Securities and Exchange

Commission, and final approval by the Company's Board of Directors.

We expect to file a Form 10 registration statement with the SEC in early calendar year 2015.

The Company is incurring incremental costs to evaluate, plan and execute the transaction. For the twelve months ended

September 30, 2014, approximately $44.7 of pre-tax charges were incurred and recorded in SG&A on the Consolidated

Statement of Earnings and Comprehensive Income. The Company will incur additional costs to execute the transaction which

will be significant and will have a material impact on our results of operations, balance sheet and cash flow.

Refer to Item 1A. Risk Factors for additional disclosure on the potential impacts of our proposed spin-off transaction.

Venezuela Devaluation and Economic Uncertainty

Effective January 1, 2010 and continuing through September 30, 2014, the financial statements for our Venezuela subsidiary are

consolidated under the rules governing the translation of financial information in a highly inflationary economy based on the

use of the blended National Consumer Price Index in Venezuela. Under GAAP, an economy is considered highly inflationary if

the cumulative inflation rate for a three year period meets or exceeds 100 percent. If a subsidiary is considered to be in a highly

inflationary economy, the financial statements of the subsidiary must be re-measured into our reporting currency (U.S. dollar)

and future exchange gains and losses from the re-measurement of monetary assets and liabilities are reflected in current

earnings, rather than exclusively in the equity section of the balance sheet, until such times as the economy is no longer

considered highly inflationary.

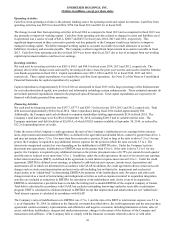

On February 13, 2013, the Venezuela government devalued the Bolivar Fuerte relative to the U.S. dollar. The revised official

exchange rate moved from 4.30 bolivars per U.S. dollar to an exchange rate of 6.30 bolivars per U.S. dollar. The Central

Government also suspended the alternate currency market administered by the central bank known as SITME that made U.S.

dollars available at a rate higher than the previous official rate, generally in the range of 5.50 bolivars per U.S. dollar. As a

result of the devaluation noted above and the elimination of the SITME market, the Company revalued its net monetary assets

at March 31, 2013 using the revised official rate of 6.30 bolivars per U.S. dollar. Thus, the Company recorded a devaluation

charge of approximately $6 during the second fiscal quarter of fiscal 2013, due primarily to the devaluation of local currency

cash balances. This charge was included in Other financing items, net on the Consolidated Statements of Earnings and

Comprehensive Income. The official exchange rate is determined and administered by the Cadivi/Cencoex System (the

National Center for International Trade who administers the authorization for the acquisition and the actual payment of foreign

currency conducted for essential imports).

On January 24, 2014, the Venezuelan government issued Exchange Agreement No. 25, which stated the rate of exchange established

in the most recent SICAD I auction will be used for payments related to international investments, royalties and the use and

exploitation of patents, trademarks, licenses, franchises and technology.

33