Energizer 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

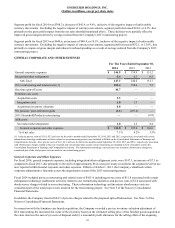

execute the transaction. For the twelve months ended September 30, 2014, $44.7 of pre-tax charges were recorded in SG&A on

the Consolidated Statements of Earnings and Comprehensive Income. The Company will incur additional costs to execute the

transaction which will be significant and will have a material impact on our results of operations, balance sheet and cash flow.

In connection with the feminine care brands acquisition, the Company recorded a pre-tax inventory valuation adjustment of

$8.0 representing the increased fair value of the inventory based on the estimated selling price of the finished goods acquired at

the close date less the sum of (a) costs of disposal and (b) a reasonable profit allowance for the selling effort of the acquiring

entity. For the twelve months ended September 30, 2014, the Company recorded $8.0 within Cost of products sold based upon

the write-up and subsequent sale of inventory acquired in the feminine care acquisition. Additionally, the Company also

recorded pre-tax acquisition/integration costs of $9.5 and $1.3 for the twelve months ended September 30, 2014 and September

30, 2013, respectively. These amounts are not reflected in the Personal Care segment, but rather presented as a separate line

item below segment profit, as it is a non-recurring item directly associated with the feminine care brands acquisition. Such

presentation reflects management’s view on how segment results are evaluated.

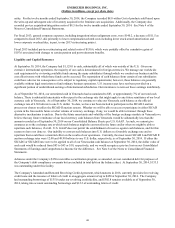

In fiscal 2013, the Company approved and communicated changes to certain pension and post-retirement benefits. Effective

January 1, 2014, the pension benefit earned to date by active participants under the legacy Energizer U.S. pension plans was

frozen and future service benefits are no longer being accrued under this retirement program. Additionally, and effective on

December 31, 2013, certain post-retirement medical and life insurance benefits were terminated. As a result of these actions,

the Company recorded pre-tax pension and post-retirement benefit gains of $107.6 for the twelve months ended September 30,

2013. The collective gains resulting from these actions, net of pension settlement charges, were reported on a separate line in

the Consolidated Statements of Earnings and Comprehensive Income. See Note 11 of the Notes to Consolidated Financial

Statements.

For the twelve months ended September 30, 2013, the Company recorded an expense of approximately $6 related to the

devaluation of its net monetary assets in Venezuela as a result of accounting for the translation of this affiliate under the

accounting rules governing a highly inflationary economy. The net monetary assets in Venezuela were valued using the revised

official exchange rate of 6.30 bolivars to one U.S. dollar at June 30, 2013. The devaluation impact of approximately $6 was

included in Other financing items, net on the Consolidated Statements of Earnings and Comprehensive Income, and was not

considered in the evaluation of segment profit. However, normal operating results in Venezuela, such as sales, gross profit and

segment profit, have and may further be negatively impacted by translating at less favorable exchange rates and by the impact

of unfavorable economic conditions in the country. These operating results remain part of the reported segment totals. The

negative segment impacts of the Venezuela devaluation and the unfavorable economic impact on operating results are discussed

separately when considered relevant to understanding year-over-year comparatives. See Note 6 of the Notes to Consolidated

Financial Statements.

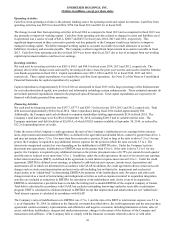

For the fiscal year ended September 30, 2012, our prior Household Products restructuring activities generated pre-tax income of

$6.8 due to the gain on the sale of our former battery manufacturing facility in Switzerland, which was shut down in fiscal

2011. This gain was approximately $13. This gain was partially offset by additional restructuring costs of $6.0. These costs,

net of the gain on the sale of the former manufacturing facility in fiscal 2012, are included as a separate line item on the

Consolidated Statements of Earnings and Comprehensive Income. See Note 5 of the Notes to Consolidated Financial

Statements.

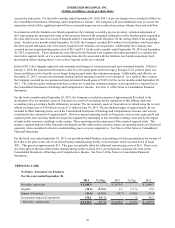

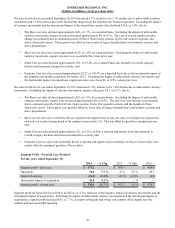

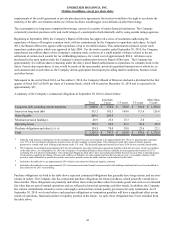

PERSONAL CARE

Net Sales - Personal Care Products

For the years ended September 30,

2014 % Chg 2013 % Chg 2012

Net sales - prior year $ 2,448.9 $ 2,479.5 $ 2,449.7

Organic (35.4) (1.4)% 4.1 0.2 % 15.0

Impact of currency (31.4) (1.3)% (34.7) (1.4)% (31.4)

Incremental impact of acquisition 230.1 9.4 % — — % 46.2

Net sales - current year $ 2,612.2 6.7 % $ 2,448.9 (1.2)% $ 2,479.5

38