Dell 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

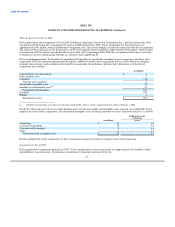

These sensitivity analyses are hypothetical in nature and should be used with caution. The analyses utilized 10% and 20% adverse

variation in assumptions to assess the sensitivities in fair values of the retained interest. However, these changes generally cannot be

extrapolated because the relationship of the change in assumptions to the change in fair value may not be linear. Further, the effect of a

variation in a particular assumption on the fair value is calculated without giving effect to any other assumption changes. It should be

noted that changes in one factor may result in changes in another factor (for example, increases in market interest rates may result in

lower prepayments and increased credit losses) that may magnify or counteract the other factor's sensitivities. The effect of multiple

factor changes were not considered in this analysis.

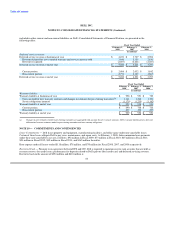

Asset Securitization

During Fiscal 2008 and Fiscal 2007, Dell sold $1.2 billion and $1.1 billion, respectively, of fixed-term leases and loans and revolving

loans to unconsolidated qualifying special purpose entities. The qualifying special purpose entities are bankruptcy remote legal entities

with assets and liabilities separate from those of Dell. The sole purpose of the qualifying special purpose entities is to facilitate the

funding of financing receivables in the capital markets. Dell determines the amount of receivables to securitize based on its funding

requirements in conjunction with specific selection criteria designed for the transaction. The qualifying special purpose entities have

entered into financing arrangements with three multi-seller conduits that, in turn, issue asset-backed debt securities in the capital markets.

Transfers of financing receivables are recorded in accordance with the provisions of SFAS 140. The principal balance of the securitized

receivables at the end of Fiscal 2008 and Fiscal 2007 was $1.2 billion and $1.0 billion, respectively.

Dell retains the right to receive collections on securitized receivables in excess of amounts needed to pay interest and principal as well as

other required fees. Upon the sale of the financing receivables, Dell records the present value of the excess cash flows as a retained

interest, which typically results in a gain that ranges from 1% to 3% of the customer receivables sold. Dell services the securitized

contracts and earns a servicing fee. Dell's securitization transactions generally do not result in servicing assets and liabilities, as the

contractual fees are adequate compensation in relation to the associated servicing cost.

Dell securitization programs contain standard structural features related to the performance of the securitized receivables. These structural

features include defined credit losses, delinquencies, average credit scores, and excess collections above or below specified levels. In the

event one or more of these features are met and Dell is unable to restructure the program, no further funding of receivables will be

permitted and the timing of expected retained interest cash flows will be delayed, which would impact the valuation of the retained

interest. Should these events occur, Dell does not expect a material adverse affect on the valuation of the retained interest or on Dell's

ability to securitize financing receivables.

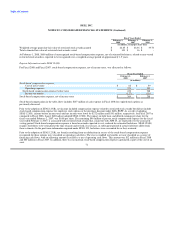

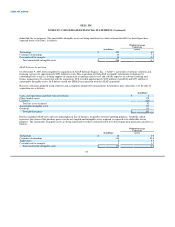

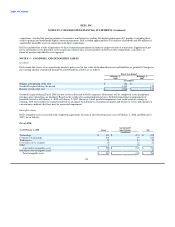

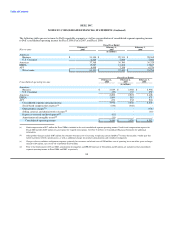

The following table presents the net credit losses and accounts 60 days or more past due of the securitized financing receivables:

Fiscal Year Ended

February 1, 2008 February 2, 2007

Dollars % Dollars %

(in millions, except percentages)

Net credit losses of securitized financing receivables $ 81 7.0%(a) $ 31 3.8%(a)

Securitized financing receivables 60 days or more delinquent $ 54 4.4%(b) $ 33 3.4%(b)

(a) Net credit losses as a percentage of the average outstanding securitized financing receivables over the year.

(b) Securitized financing receivables 60 days or more delinquent divided by ending securitized financing receivables balance.

78