Dell 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

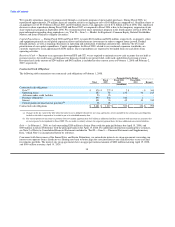

Table of Contents

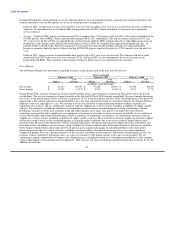

The floating rates are based on three-month London Interbank Offered Rates plus 0.41% and 0.79% for the Senior Notes and Senior

Debentures, respectively. As a result of the interest rate swap agreements, our effective interest rates for the Senior Notes and Senior

Debentures were 5.9% and 6.2%, respectively, for Fiscal 2008.

Operating Leases — We lease property and equipment, manufacturing facilities, and office space under non-cancellable leases. Certain

of these leases obligate us to pay taxes, maintenance, and repair costs.

Advances Under Credit Facilities — Dell India Pvt Ltd., our wholly-owned subsidiary, maintains unsecured short-term credit facilities

with Citibank N.A. Bangalore Branch India ("Citibank India") that provide a maximum capacity of $30 million to fund Dell India's

working capital and import buyers credit needs. Financing is available in both Indian Rupees and foreign currencies. The borrowings are

extended on an unsecured basis based on our guarantee to Citibank U.S. Citibank India can cancel the facilities in whole or in part

without prior notice, at which time any amounts owed under the facilities will become immediately due and payable. Interest on the

outstanding loans is charged monthly and is calculated based on Citibank India's internal cost of funds plus 0.25%. At February 1, 2008,

outstanding advances from Citibank India totaled $23 million, which are included in short-term borrowings on our Consolidated

Statement of Financial Position.

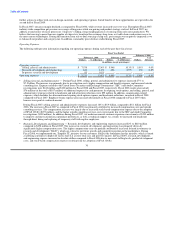

Purchase Obligations — Purchase obligations are defined as contractual obligations to purchase goods or services that are enforceable

and legally binding on us. These obligations specify all significant terms, including fixed or minimum quantities to be purchased; fixed,

minimum, or variable price provisions; and the approximate timing of the transaction. Purchase obligations do not include contracts that

may be cancelled without penalty.

We utilize several suppliers to manufacture sub-assemblies for our products. Our efficient supply chain management allows us to enter

into flexible and mutually beneficial purchase arrangements with our suppliers in order to minimize inventory risk. Consistent with

industry practice, we acquire raw materials or other goods and services, including product components, by issuing to suppliers

authorizations to purchase based on our projected demand and manufacturing needs. These purchase orders are typically fulfilled within

30 days and are entered into during the ordinary course of business in order to establish best pricing and continuity of supply for our

production. Purchase orders are not included in the table above as they typically represent our authorization to purchase rather than

binding purchase obligations.

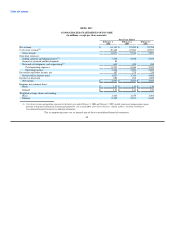

Purchase obligations increased to $893 million at February 1, 2008, from $570 million at February 2, 2007. The significant increase is

mainly due to the signing of a $450 million marketing services agreement with a vendor during the fourth quarter of Fiscal 2008, partially

offset by a $99 million decrease in purchase commitments related to the improvement and construction of facilities as several projects

were finished during Fiscal 2008, and a net decrease in our other purchase commitments.

Interest — See Note 2 of Notes to the Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and

Supplementary Data" for further discussion of our debt and related interest expense.

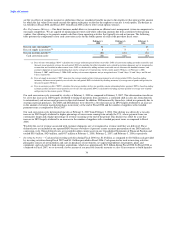

Market Risk

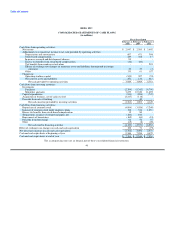

We are exposed to a variety of risks, including foreign currency exchange rate fluctuations and changes in the market value of our

investments. In the normal course of business, we employ established policies and procedures to manage these risks.

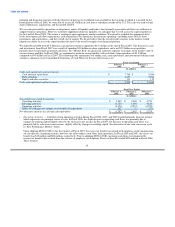

Foreign Currency Hedging Activities

Our objective in managing our exposures to foreign currency exchange rate fluctuations is to reduce the impact of adverse fluctuations on

earnings and cash flows associated with foreign currency exchange rate changes. Accordingly, we utilize foreign currency option

contracts and forward contracts to hedge our exposure on forecasted transactions and firm commitments in over 20 currencies in which

we transact business. The principal currencies hedged during Fiscal 2008 were the Euro, British Pound, Japanese Yen, and Canadian

Dollar. We monitor our foreign currency exchange exposures to ensure the overall effectiveness of our foreign currency hedge positions.

However, there can be no assurance that our foreign currency hedging activities will substantially offset the impact of fluctuations in

currency exchange rates on our results of operations and financial position. During Fiscal 2008, the U.S. dollar weakened relative to the

other principal currencies in which we transact business.

39