Dell 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

$30 million; and 2012: $4 million. Fixed-term loans are also offered to qualified small businesses and primarily consist of loans

with short-term maturities.

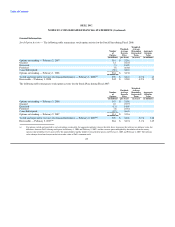

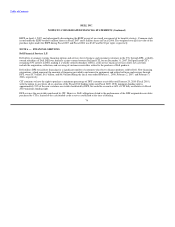

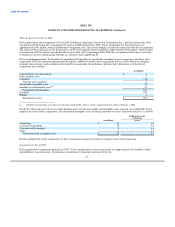

The following table presents the net credit losses and accounts 60 days or more past due of customer receivables. Net credit losses on

leases and loans represent net investment balances. Net credit losses on revolving loans represent principal losses, net of recoveries. Net

credit losses increased in Fiscal 2008 due to higher delinquencies driven by deterioration in the credit environment.

Fiscal Year Ended

February 1, 2008 February 2, 2007

Dollars % Dollars %

(in millions, except percentages)

Net credit losses of customer financing receivables $ 40 2.7%(a) $ 20 1.5%(a)

Customer financing receivables 60 days or more delinquent $ 34 2.1%(b) $ 10 0.7%(b)

(a) Net credit losses as a percentage of the outstanding average customer receivables balance over the year.

(b) Customer financing receivables 60 days or more delinquent divided by the ending customer financing receivables balance.

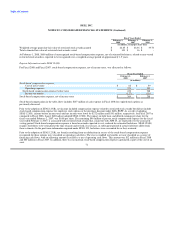

• Dell retains a residual interest in the leased equipment. The amount of the residual interest is established at the inception of the lease

based upon estimates of the value of the equipment at the end of the lease term using historical studies, industry data, and future

value-at-risk demand valuation methods. On a periodic basis, Dell assesses the carrying amount of its recorded residual values for

impairment. Anticipated declines in specific future residual values that are considered to be other-than-temporary are recorded in

current earnings.

• Retained interests represent the residual beneficial interest Dell retains in certain pools of securitized financing receivables. Retained

interests are stated at the present value of the estimated net beneficial cash flows after payment of all senior interests. In estimating

the value of retained interests, Dell makes a variety of financial assumptions, including pool credit losses, payment rates, and

discount rates. These assumptions are supported by both Dell's historical experience and anticipated trends relative to the particular

receivable pool. Dell reviews its investments in retained interests periodically for impairment, based on estimated fair value. In the

first quarter of Fiscal 2008, Dell adopted SFAS 155, and as a result, all gains and losses are recognized in income immediately.

76