Dell 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

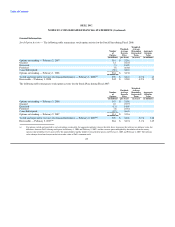

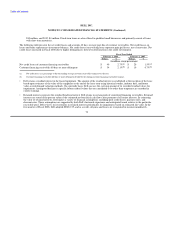

Stock Option Agreements — The right to purchase shares pursuant to existing stock option agreements typically vests pro-rata at

each option anniversary date over a three- to five-year period. The options, which are granted with option exercise prices equal to

the fair market value of Dell's common stock on the date of grant, generally expire within ten to twelve years from the date of grant.

Dell has not issued any options to consultants or advisors to Dell since Fiscal 1999. In conjunction with the adoption of

SFAS 123(R) in the first quarter of Fiscal 2007, Dell changed its method of attributing the value of stock-based compensation

expense from an accelerated approach to a straight-line method. Compensation expense for all stock option awards granted on or

prior to February 3, 2006, uses the accelerated approach with an exception of stock options granted in Fiscal 2002 and Fiscal 2003,

for which the straight-line method is used.

Restricted Stock Awards — Awards of restricted stock may be either grants of restricted stock, restricted stock units, or

performance-based stock units that are issued at no cost to the recipient. For restricted stock grants, at the date of grant, the recipient

has all rights of a stockholder, subject to certain restrictions on transferability and a risk of forfeiture. Restricted stock grants

typically vest over a three- to seven-year period beginning on the date of grant. For restricted stock units, legal ownership of the

shares is not transferred to the employee until the unit vests, which is generally over a three-to five-year period. Dell also grants

performance-based restricted stock units as a long-term incentive in which an award recipient receives shares contingent upon Dell

achieving performance objectives and the employees' continuing employment through the vesting period, which is generally over a

three- to five-year period. Compensation expense recorded in connection with these performance-based restricted stock units is

based on Dell's best estimate of the number of shares that will eventually be issued upon achievement of the specified performance

criteria and when it becomes probable that certain performance goals will be achieved. The cost of these awards is determined using

the fair market value of Dell's common stock on the date of the grant. Compensation expense for restricted stock awards with a

service condition is recognized on a straight-line basis over the vesting term. Compensation expense for performance-based

restricted stock awards is recognized on an accelerated multiple-award approach based on the most probable outcome of the

performance condition. In accordance with SFAS 123(R), deferred compensation related to restricted stock awards issued prior to

Fiscal 2007, which was previously classified as "other" in stockholders' equity, was classified as capital in excess of par value upon

adoption.

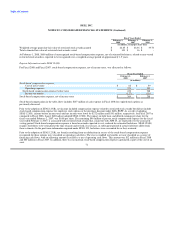

Temporary Suspension of Option Exercises, Vesting of Restricted Stock Units, and Employee Stock Purchase Plan ("ESPP") Purchases

— As a result of Dell's inability to timely file its Annual Report on Form 10-K for Fiscal 2007, Dell suspended the exercise of employee

stock options, settlement vesting of restricted stock units, and the purchase of shares under the ESPP on April 4, 2007. Dell resumed

allowing the exercise of employee stock options by employees and the settlement of restricted stock units on October 31, 2007. The

purchase of shares under the ESPP will not be resumed as the plan has been discontinued effective the first quarter of Fiscal 2009.

Dell agreed to pay cash to current and former employees who held in-the-money stock options (options that have an exercise price less

than the current market stock price) that expired during the period of unexercisability due to Dell's inability to timely file its Annual

Report on Form 10-K for Fiscal 2007. Dell has made payments of approximately $107 million relating to in-the-money stock options that

expired in the second and third quarters of Fiscal 2008. Of the $107 million total, $17 million is included in cost of net revenue and

$90 million in operating expenses. As options have again become exercisable, Dell does not expect to pay cash for expired in-the-money

stock options in the future.

68