Dell 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

assets and liabilities separate from ours. The sole purpose of the qualifying special purpose entities is to facilitate the funding of customer

receivables in the capital markets. Once sold, these receivables are off-balance sheet. We determined the amount of receivables to

securitize based on our funding requirements in conjunction with specific selection criteria designed for the transaction.

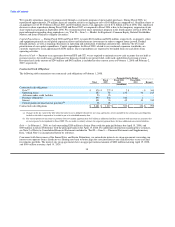

Off-balance sheet securitizations involve the transfer of customer financing receivables to unconsolidated qualifying special purpose

entities that are accounted for as a sale in accordance with SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets

and Extinguishment of Liabilities, ("SFAS 140"). Upon the sale of the customer receivables, we recognize a gain on the sale and retain an

interest in the assets sold. The gain on sale ranges from 1% to 3% of the customer receivables sold. The unconsolidated qualifying special

purpose entities have entered into financing arrangements with various multi-seller conduits that, in turn, issue asset-backed debt

securities in the capital markets. During Fiscal 2008 and Fiscal 2007, we sold $1.2 billion and $1.1 billion, respectively, of customer

receivables to unconsolidated qualifying special purpose entities. The principal balance of the securitized receivables at the end of Fiscal

2008 and Fiscal 2007 was $1.2 billion and $1.0 billion, respectively.

We provide credit enhancement to the securitization in the form of over-collateralization. Receivables transferred to the qualified special

purpose entities exceed the level of debt issued. We retain the right to receive collections for assets securitized exceeding the amount

required to pay interest, principal, and other fees and expenses (referred to as retained interest). Our retained interest in the securitizations

is determined by calculating the present value of these excess cash flows over the expected duration of the transactions. Our risk of loss

related to securitized receivables is limited to the amount of our retained interest. We service securitized contracts and earn a servicing

fee. Our securitization transactions generally do not result in servicing assets and liabilities, as the contractual fees are adequate

compensation in relation to the associated servicing cost.

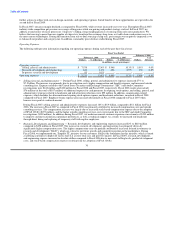

In estimating the value of the retained interest, we make a variety of financial assumptions, including pool credit losses, payment rates,

and discount rates. These assumptions are supported by both our historical experience and anticipated trends relative to the particular

receivable pool. We review our investments in retained interests periodically for impairment, based on their estimated fair value. All

gains and losses are recognized in income immediately. Retained interest balances and assumptions are disclosed in Note 6 of Notes to

Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary Data."

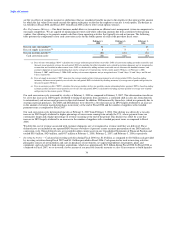

Our securitization programs contain standard structural features related to the performance of the securitized receivables. These structural

features include defined credit losses, delinquencies, average credit scores, and excess collections above or below specified levels. In the

event one or more of these features are met and we are unable to restructure the program, no further funding of receivables will be

permitted and the timing of expected retained interest cash flows will be delayed which would impact the valuation of our retained

interest. Should these events occur, we do not expect a material adverse affect on the valuation of the retained interest or on our ability to

securitize financing receivables.

Current capital markets are experiencing an unusual period of volatility and reduced liquidity that we expect will result in higher costs

and increasing credit enhancements for funding of financial assets. Our exposure to the capital markets will increase as we continue to

fund additional financing receivables. We do not expect current capital market conditions to limit our ability to access liquidity for

funding financing receivables in the future, as we continue to find funding sources in the capital markets.

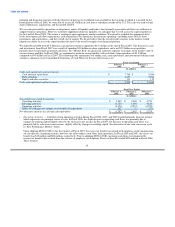

Liquidity, Capital Commitments, and Contractual Cash Obligations

Liquidity

Our cash balances are held in numerous locations throughout the world, including substantial amounts held outside of the U.S.; however,

the majority of our cash and investments that are located outside of the U.S. are denominated in the U.S. dollar. Most of the amounts held

outside of the U.S. could be repatriated to the U.S., but, under current law, would be subject to U.S. federal income taxes, less applicable

foreign tax credits. Repatriation of some foreign balances is restricted by local laws. We have provided for the U.S. federal tax liability on

these amounts for financial statement purposes except for foreign earnings that are considered indefinitely reinvested outside of the

U.S. Repatriation could result in additional U.S. federal income tax payments in future years. We utilize a variety of tax

34