Dell 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

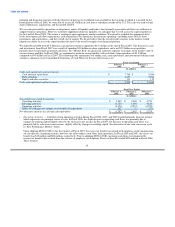

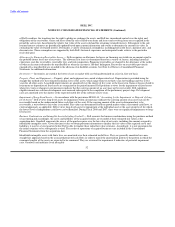

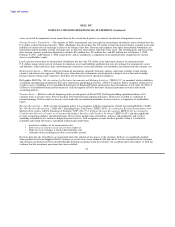

Warranty — We record warranty liabilities at the time of sale for the estimated costs that may be incurred under the terms of the limited

warranty. The specific warranty terms and conditions vary depending upon the product sold and country in which we do business, but

generally include technical support, parts, and labor over a period ranging from one to three years. Factors that affect our warranty

liability include the number of installed units currently under warranty, historical and anticipated rates of warranty claims on those units,

and cost per claim to satisfy our warranty obligation. The anticipated rate of warranty claims is the primary factor impacting our

estimated warranty obligation. The other factors are less significant due to the fact that the average remaining aggregate warranty period

of the covered installed base is approximately 20 months, repair parts are generally already in stock or available at pre-determined prices,

and labor rates are generally arranged at pre-established amounts with service providers. Warranty claims are reasonably predictable

based on historical experience of failure rates. If actual results differ from our estimates, we revise our estimated warranty liability to

reflect such changes. Each quarter, we reevaluate our estimates to assess the adequacy of the recorded warranty liabilities and adjust the

amounts as necessary.

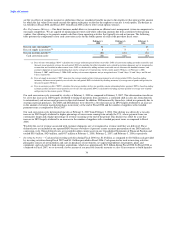

Income Taxes — We calculate a provision for income taxes using the asset and liability method, under which deferred tax assets and

liabilities are recognized by identifying the temporary differences arising from the different treatment of items for tax and accounting

purposes. In determining the future tax consequences of events that have been recognized in our financial statements or tax returns,

judgment is required. Differences between the anticipated and actual outcomes of these future tax consequences could have a material

impact on our consolidated results of operations or financial position.

Stock-Based Compensation — Effective February 4, 2006, we adopted SFAS 123(R) using the modified prospective transition method

which does not require revising the presentation in prior periods for stock-based compensation. Under this transition method, stock-based

compensation expense for Fiscal 2008 and Fiscal 2007 includes compensation expense for all stock-based compensation awards granted

prior to February 4, 2006, but not yet vested at February 3, 2006, based on the grant date fair value estimated in accordance with the

original provisions of SFAS No. 123, Accounting for Stock-Based Compensation ("SFAS 123"). Stock-based compensation expense for

all stock-based compensation awards granted after February 3, 2006 is based on the grant-date fair value estimated in accordance with the

provisions of SFAS 123(R). We recognize this compensation expense net of an estimated forfeiture rate over the requisite service period

of the award, which is generally the vesting term of three-to-five years for stock options and three-to-five years for restricted stock

awards. In March 2005, the SEC issued Staff Accounting Bulletin No. 107 ("SAB 107") regarding the SEC's interpretation of

SFAS 123(R) and the valuation of share-based payments for public companies. We have applied the provisions of SAB 107 in our

adoption of SFAS 123(R).

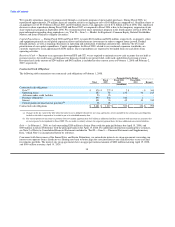

SFAS 123(R) requires the use of a valuation model to calculate the fair value of stock option awards. We have elected to use the Black-

Scholes option pricing model, which incorporates various assumptions, including volatility, expected term, and risk-free interest rates.

The volatility is based on a blend of implied and historical volatility of our common stock over the most recent period commensurate

with the estimated expected term of our stock options. We use this blend of implied and historical volatility, as well as other economic

data, because we believe such volatility is more representative of prospective trends. The expected term of an award is based on historical

experience and on the terms and conditions of the stock awards granted to employees. The dividend yield of zero is based on the fact that

we have never paid cash dividends and have no present intention to pay cash dividends.

The cost of restricted stock awards is determined using the fair market value of our common stock on the date of grant.

Prior to the adoption of SFAS 123(R), we measured compensation expense for our employee stock-based compensation plan using the

intrinsic value method prescribed by APB 25. We applied the disclosure provisions of SFAS 123 such that the fair value of employee

stock-based compensation was disclosed in the notes to our consolidated financial statements. Under APB 25, when the exercise price of

our employee stock options equaled the market price of the underlying stock at the date of the grant, no compensation expense was

recognized.

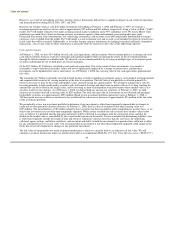

Loss Contingencies — We are subject to the possibility of various losses arising in the ordinary course of business. We consider the

likelihood of loss or impairment of an asset or the incurrence of a liability, as well as our ability to reasonably estimate the amount of

loss, in determining loss contingencies. An estimated loss contingency is accrued

43