Dell 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

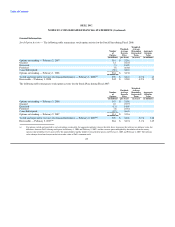

Financing Receivables

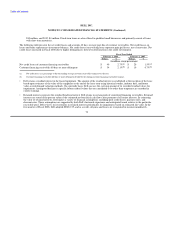

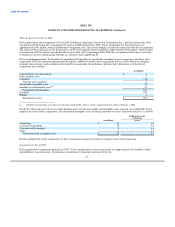

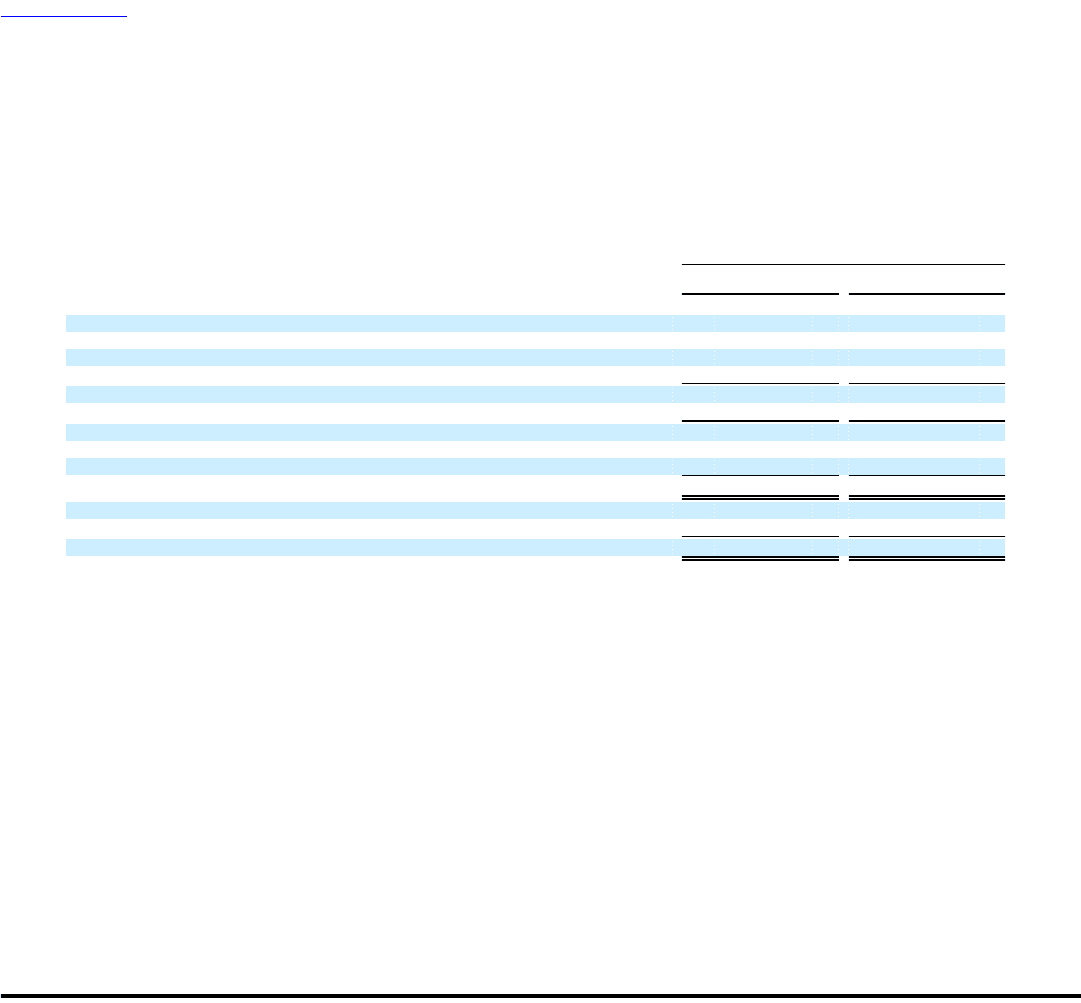

The following table summarizes the components of Dell's financing receivables, net of the allowance for doubtful accounts:

Fiscal Year Ended

February 1, February 2,

2008 2007

(in millions)

Financing receivables, net:

Customer receivables:

Revolving loans, gross $ 1,063 $ 805

Fixed-term leases and loans, gross 654 632

Customer receivables, gross 1,717 1,437

Customer receivables allowance (96) (39)

Customer receivables, net 1,621 1,398

Residual interest 295 296

Retained interest 223 159

Financing receivables, net $ 2,139 $ 1,853

Short-term $ 1,732 $ 1,530

Long-term 407 323

Financing receivables, net $ 2,139 $ 1,853

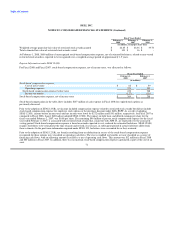

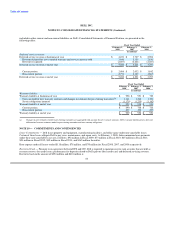

Financing receivables consist of customer receivables, residual interest, and retained interest in securitized receivables. Customer

receivables include fixed-term loans and leases and revolving loans resulting from the sale of Dell products and services. For customers

who desire lease financing, Dell enters into sales-type lease arrangements with the customers. Of the customer receivables balance,

$444 million represent balances which are due from CIT in connection with specified promotional programs.

• Customer receivables are presented net of allowance for uncollectible accounts. The allowance is based on factors including

historical experience, past due receivables, receivable type, and the risk composition of the receivables. The composition and credit

quality varies from investment grade commercial customers to subprime consumers. Subprime receivables comprise less than 20% of

the net customer receivable balance at February 1, 2008. Financing receivables are charged to the allowance at the earlier of when an

account is deemed to be uncollectible or when an account is 180 days delinquent. Recoveries on customer receivables previously

charged off as uncollectible are recorded to the allowance for uncollectible accounts. The following is a description of the

components of financing receivables.

– Revolving loans offered under private label credit financing programs provide qualified customers with a revolving credit line for

the purchase of products and services offered by Dell. Revolving loans bear interest at a variable annual percentage rate that is tied

to the prime rate. From time to time, account holders may have the opportunity to finance their Dell purchases with special

programs during which, if the outstanding balance is paid in full, no interest is charged. These special programs generally range

from 3 to 12 months and have an average original term of approximately 11 months. At February 1, 2008 and February 2, 2007,

$668 million and $694 million, respectively, were receivables under these special programs.

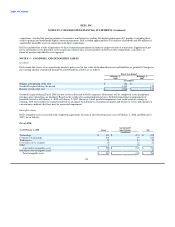

– Leases with business customers generally have fixed terms of two to three years. Future maturities of minimum lease payments at

February 1, 2008, are as follows: 2009: $137 million; 2010: $74 million; 2011:

75