Dell 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

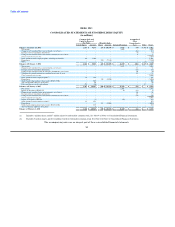

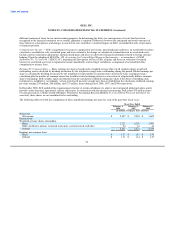

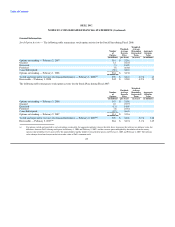

The following table summarizes Dell's debt securities that had unrealized losses at February 1, 2008:

Less Than 12 Months

Unrealized 12 Months or Greater Total

Fair Value Loss Fair Value Unrealized Loss Fair Value Unrealized Loss

(in millions)

Debt securities:

U.S. government and agencies $ 29 $ (1) $ 59 $ (0) $ 88 $ (1)

U.S. corporate 38 (8) 27 (0) 65 (8)

International corporate - - 2 - 2 -

State and municipal governments - - - - - -

Total debt securities $ 67 $ (9) $ 88 $ (0) $ 155 $ (9)

At February 1, 2008, Dell had 40 debt securities that had fair values below their carrying values for a period of less than 12 months and

51 debt securities that had fair values below their carrying values for a period of more than 12 months. The unrealized losses are due to

changes in interest rates and are expected to be recovered over the contractual term of the instruments.

Dell periodically reviews its investment portfolio to determine if any investment is other-than-temporarily impaired due to changes in

credit risk or other potential valuation concerns. The unrealized loss of $9 million has been recorded in other comprehensive income

(loss), as Dell believes that the investments are not other-than-temporarily impaired. While certain available-for-sale securities have

market values below cost, Dell believes it is probable that the principal and interest will be collected in accordance with the contractual

terms, and that the decline in the market value is exacerbated by the overall credit concerns in the market. Factors considered in

determining whether a loss is other-than-temporary include the length of time and extent to which fair value has been less than the cost

basis, the underlying collateral, agency ratings, future cash flows, and Dell's intent and ability to hold the investment for a period of time

sufficient to allow for any anticipated recovery in fair value. Dell's assessment that an investment is not other-than-temporarily impaired

could change in the future due to new developments or changes in any particular investment.

The fair value of Dell's portfolio was based on quoted market prices, which Dell currently believes are indicative of fair value. Dell will

continue to evaluate whether the inputs are market observable as it implements SFAS 157.

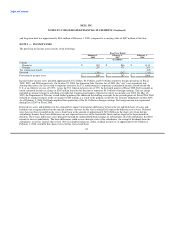

The following table summarizes Dell's realized gains and losses on investments:

Fiscal Year Ended

February 1, February 2, February 3,

2008 2007 2006

(in millions)

Gains $ 17 $ 9 $ 13

Losses (3) (14) (15)

Net realized gain (loss) $ 14 $ (5) $ (2)

Dell routinely enters into securities lending agreements with financial institutions in order to enhance investment income. Dell requires

that the loaned securities be collateralized in the form of cash or securities for values which generally exceed the value of the loaned

security. At February 1, 2008 and February 2, 2007, there were no securities on loan.

60