Dell 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

of Dell's creditors, the transferee has the right to pledge or exchange the assets, and Dell has surrendered control over the rights and

obligations of the receivables. Gains and losses from the sale of fixed-term loans and leases and revolving loans are recognized in the

period the sale occurs, based upon the relative fair value of the assets sold and the remaining retained interests. Subsequent to the sale,

retained interest estimates are periodically updated based upon current information and events to determine the current fair value. In

estimating the value of retained interest, Dell makes a variety of financial assumptions, including pool credit losses, payment rates, and

discount rates. These assumptions are supported by both Dell's historical experience and anticipated trends relative to the particular

receivable pool.

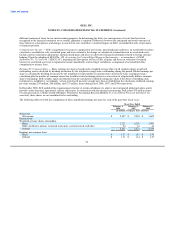

Allowance for Financing Receivables Losses — Dell recognizes an allowance for losses on financing receivables in an amount equal to

the probable future losses net of recoveries. The allowance for losses is determined based on a variety of factors, including historical

experience, past due receivables, receivable type, and risk composition. Financing receivables are charged to the allowance at the earlier

of when an account is deemed to be uncollectible or when the account is 180 days delinquent. Recoveries on receivables previously

charged off as uncollectible are recorded to the allowance for doubtful accounts. See Note 6 of Notes to Consolidated Financial

Statements for additional information.

Inventories — Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out basis.

Property, Plant, and Equipment — Property, plant, and equipment are carried at depreciated cost. Depreciation is provided using the

straight-line method over the estimated economic lives of the assets, which range from ten to thirty years for buildings and two to five

years for all other assets. Leasehold improvements are amortized over the shorter of five years or the lease term. Gains or losses related to

retirements or disposition of fixed assets are recognized in the period incurred. Dell performs reviews for the impairment of fixed assets

whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Dell capitalizes

eligible internal-use software development costs incurred subsequent to the completion of the preliminary project stage. Development

costs are amortized over the shorter of the expected useful life of the software or five years.

Impairment of Long-Lived Assets — In accordance with the provisions SFAS 144, "Accounting for the Impairment or Disposal of Long-

Lived Assets," Dell reviews long-lived assets for impairment when circumstances indicate the carrying amount of an asset may not be

recoverable based on the undiscounted future cash flows of the asset. If the carrying amount of the asset is determined not to be

recoverable, a write-down to fair value is recorded. Fair values are determined based on quoted market values, discounted cash flows, or

external appraisals, as applicable. Dell reviews long-lived assets for impairment at the individual asset or the asset group level for which

the lowest level of independent cash flows can be identified. During Fiscal 2008 and 2007, there were no significant impairments to long-

lived assets.

Business Combinations and Intangible Assets Including Goodwill — Dell accounts for business combinations using the purchase method

of accounting and accordingly, the assets and liabilities of the acquired entities are recorded at their estimated fair values at the

acquisition date. Goodwill represents the excess of the purchase price over the fair value of net assets, including the amount assigned to

identifiable intangible assets. Given the time it takes to obtain pertinent information to finalize the fair value of the acquired assets and

liabilities, it may be several quarters before Dell is able to finalize those initial fair value estimates. Accordingly, it is not uncommon for

the initial estimates to be subsequently revised. The results of operations of acquired businesses are included in the Consolidated

Financial Statements from the acquisition date.

Identifiable intangible assets with finite lives are amortized over their estimated useful lives. They are generally amortized on a non-

straight line approach based on the associated projected cash flows in order to match the amortization pattern to the pattern in which the

economic benefits of the assets are expected to be consumed. They are reviewed for impairment if indicators of potential impairment

exist. Goodwill and indefinite lived intangible

52