Dell 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

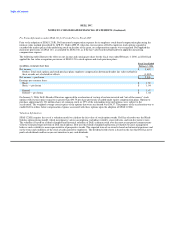

DFS Credit Facilities

Prior to Dell's purchase of CIT's 30% ownership interest in DFS in December 2007, DFS maintained credit facilities with CIT that

provided a maximum capacity of $750 million to fund leased equipment. These borrowings were secured by DFS' assets and contained

certain customary restrictive covenants. Interest on the outstanding loans was paid quarterly and calculated based on an average of the

two- and three-year U.S. Treasury Notes plus 4.45%. DFS was required to make quarterly payments if the value of the leased equipment

securing the loans was less than the outstanding principal balance. At February 1, 2008, there were no outstanding advances from CIT as

the credit facilities terminated upon Dell's acquisition of the remaining ownership interest in DFS. At February 2, 2007, outstanding

advances from CIT totaled $122 million, of which $87 million was included in short-term borrowings, and $35 million was included in

long-term debt on Dell's Consolidated Statements of Financial Position.

India Credit Facilities

Dell India Pvt Ltd., Dell's wholly-owned subsidiary, maintains unsecured short-term credit facilities with Citibank N.A. Bangalore

Branch India ("Citibank India") that provide a maximum capacity of $30 million to fund Dell India's working capital and import buyers'

credit needs. Financing is available in both Indian rupees and foreign currencies. The borrowings are extended on an unsecured basis

based on Dell's guarantee to Citibank U.S. Citibank India can cancel the facilities in whole or in part without prior notice, at which time

any amounts owed under the facilities will become immediately due and payable. Interest on the outstanding loans is charged monthly

and is calculated based on Citibank India's internal cost of funds plus 0.25%. At February 1, 2008, outstanding advances from Citibank

India totaled $23 million, which is included in short-term borrowings on Dell's Consolidated Statement of Financial Position.

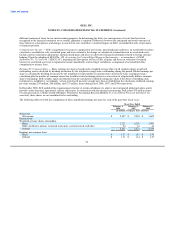

Long-Term Debt and Interest Rate Risk Management

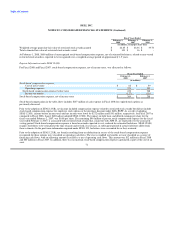

In April 1998, Dell issued $200 million 6.55% fixed rate senior notes with the principal balance due April 15, 2008 (the "Senior Notes")

and $300 million 7.10% fixed rate senior debentures with the principal balance due April 15, 2028 (the "Senior Debentures"). Interest on

the Senior Notes and Senior Debentures is paid semi-annually, on April 15 and October 15. The Senior Notes and Senior Debentures rank

equally and are redeemable, in whole or in part, at the election of Dell for principal, any accrued interest, and a redemption premium

based on the present value of interest to be paid over the term of the debt agreements. The Senior Notes and Senior Debentures generally

contain no restrictive covenants, other than a limitation on liens on Dell's assets and a limitation on sale-leaseback transactions involving

Dell property. In early Fiscal 2009, we plan to obtain additional long-term debt financing.

Concurrent with the issuance of the Senior Notes and Senior Debentures, Dell entered into interest rate swap agreements converting

Dell's interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate characteristics to its cash

and investments portfolio. The interest rate swap agreements have an aggregate notional amount of $200 million maturing April 15, 2008

and $300 million maturing April 15, 2028. The floating rates are based on three-month London Interbank Offered Rates plus 0.41% and

0.79% for the Senior Notes and Senior Debentures, respectively. As a result of the interest rate swap agreements, Dell's effective interest

rates for the Senior Notes and Senior Debentures were 5.9% and 6.2%, respectively, for Fiscal 2008.

The interest rate swap agreements are designated as fair value hedges. Although the Senior Notes and Senior Debentures allow for

settlement before their stated maturity, such settlement would always be at an amount greater than the fair value of the Senior Notes and

Senior Debentures. Accordingly, the Senior Notes and Senior Debentures are not considered to be pre-payable as defined by SFAS 133

and related interpretations. The changes in the fair value of the interest rate swaps are assessed in accordance with SFAS 133 and

reflected in the carrying value of the interest rate swaps on the balance sheet. The estimated fair value is based primarily on projected

future swap rates. The carrying value of the debt is adjusted by an equal and offsetting amount. The estimated fair value of the short

63