Dell 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

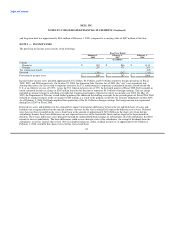

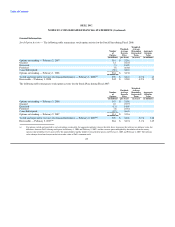

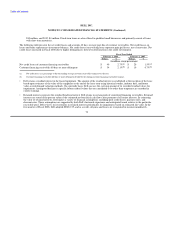

Fiscal Years Ended

February 1, February 2, February 3,

2008 2007 2006

(in millions, except per share data)

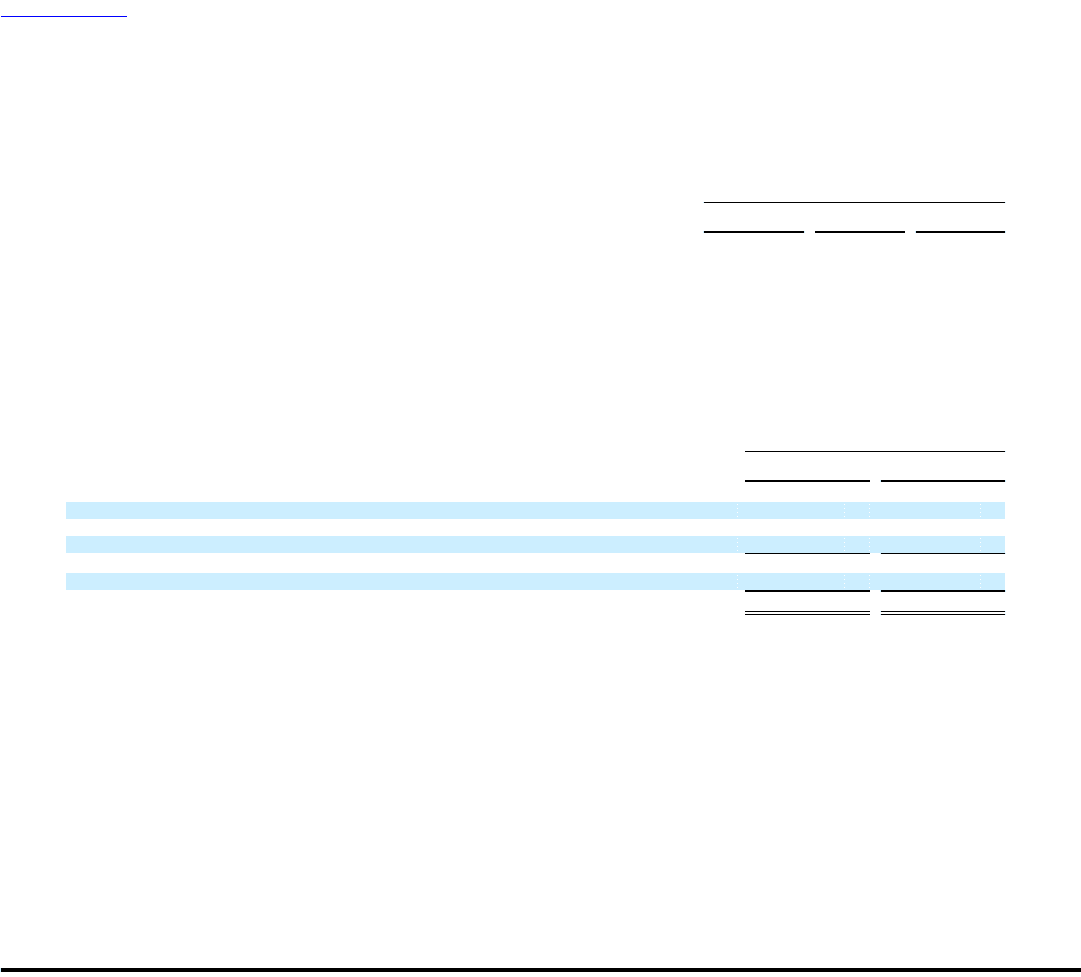

Weighted-average grant date fair value of restricted stock awards granted $ 22.85 $ 28.36 $ 39.70

Total estimated fair value of restricted stock awards vested $ 103 $ 16 $ -

At February 1, 2008, $600 million of unrecognized stock-based compensation expense, net of estimated forfeitures, related to non-vested

restricted stock awards is expected to be recognized over a weighted-average period of approximately 1.9 years.

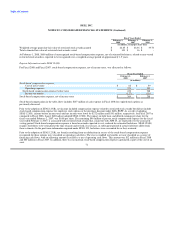

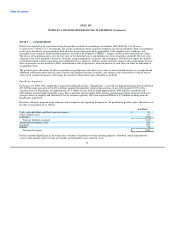

Expense Information under SFAS 123(R)

For Fiscal 2008 and Fiscal 2007, stock-based compensation expense, net of income taxes, was allocated as follows:

Fiscal Year Ended

February 1, February 2,

2008 2007

(in millions)

Stock-based compensation expense:

Cost of net revenue $ 62 $ 59

Operating expenses 374 309

Stock-based compensation expense before taxes 436 368

Income tax benefit (127) (110)

Stock-based compensation expense, net of income taxes $ 309 $ 258

Stock-based compensation in the table above includes $107 million of cash expense in Fiscal 2008 for expired stock options as

previously discussed.

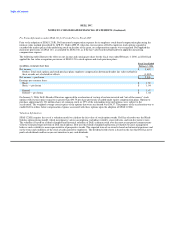

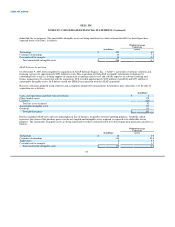

Prior to the adoption of SFAS 123(R), net income included compensation expense related to restricted stock awards but did not include

stock-based compensation expense for employee stock options or the purchase discount under Dell's ESPP. As a result of adopting

SFAS 123(R), income before income taxes and net income were lower by $272 million and $191 million, respectively, for Fiscal 2007 as

compared to Fiscal 2006, than if Dell had not adopted SFAS 123(R). The impact on both basic and diluted earnings per share for the

fiscal year ended February 2, 2007, was $0.08 per share. The remaining $96 million of pre-tax stock compensation expense for the fiscal

year ended February 2, 2007, is associated with restricted stock awards that, consistent with APB 25, are expensed over the associated

vesting period. Stock-based compensation expense is based on awards expected to vest, reduced for estimated forfeitures. SFAS 123(R)

requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from

those estimates. In the pro forma information required under SFAS 123, forfeitures were accounted for as they occurred.

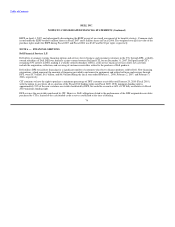

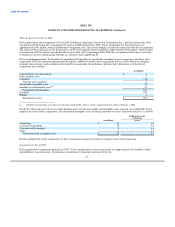

Prior to the adoption of SFAS 123(R), tax benefits resulting from tax deductions in excess of the stock-based compensation expense

recognized for those options were classified as operating cash flows. The excess windfall tax benefits are now classified as a source of

financing cash flows, with an offsetting amount classified as a use of operating cash flows. This amount was $12 million in Fiscal 2008

and $80 million in Fiscal 2007. In addition, there was no material stock-based compensation expense capitalized as part of the cost of an

asset. 71