Dell 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

and long-term debt was approximately $563 million at February 1, 2008, compared to a carrying value of $497 million at that date.

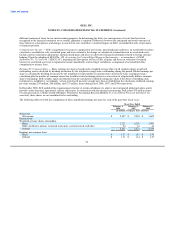

NOTE 3 — INCOME TAXES

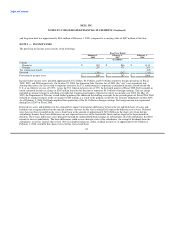

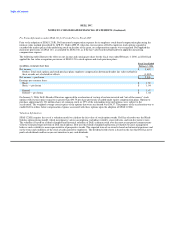

The provision for income taxes consists of the following:

Fiscal Year Ended

February 1, February 2, February 3,

2008 2007 2006

(in millions)

Current:

Domestic $ 901 $ 846 $ 1,141

Foreign 287 178 263

Tax repatriation benefit - - (85)

Deferred (308) (262) (313)

Provision for income taxes $ 880 $ 762 $ 1,006

Income before income taxes included approximately $3.2 billion, $2.6 billion, and $3.0 billion related to foreign operations in Fiscal

2008, 2007, and 2006 respectively. On October 22, 2004, the American Jobs Creation Act of 2004 (the "Act") was signed into law.

Among other items, the Act created a temporary incentive for U.S. multinationals to repatriate accumulated income earned outside the

U.S. at an effective tax rate of 5.25%, versus the U.S. federal statutory rate of 35%. In the fourth quarter of Fiscal 2005, Dell recorded an

initial estimated income tax charge of $280 million based on the decision to repatriate $4.1 billion of foreign earnings. This tax charge

included an amount relating to a drafting oversight that Congressional leaders expected to correct in calendar year 2005. On May 10,

2005, the Department of Treasury issued further guidance that addressed the drafting oversight. In the second quarter of Fiscal 2006, Dell

reduced its original estimate of the tax charge by $85 million as a result of the guidance issued by the Treasury Department in May 2005.

As of February 3, 2006, Dell had completed the repatriation of the $4.1 billion in foreign earnings. No foreign income was repatriated

during Fiscal 2007 or Fiscal 2008.

Deferred tax assets and liabilities for the estimated tax impact of temporary differences between the tax and book basis of assets and

liabilities are recognized based on the enacted statutory tax rates for the year in which Dell expects the differences to reverse. Deferred

taxes have not been recorded on the excess book basis in the amount of approximately $10.8 billion in the shares of certain foreign

subsidiaries because these basis differences are not expected to reverse in the foreseeable future and are expected to be permanent in

duration. These basis differences arose primarily through the undistributed book earnings of substantially all of the subsidiaries that Dell

intends to reinvest indefinitely. The basis differences could reverse through a sale of the subsidiaries, the receipt of dividends from the

subsidiaries as well as various other events. Net of available foreign tax credits, residual income tax of approximately $3.5 billion at

February 1, 2008, would be due upon reversal of this excess book basis.

64