Dell 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

shortening our product development cycle time and examining our supply chain models. Lastly, we are examining our pricing

and margin strategies to improve our profitability.

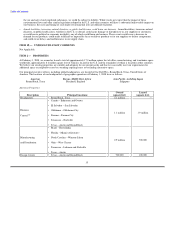

• Reigniting growth — We are enabling our growth strategy by focusing on five key areas:

– Global Consumer — In Fiscal 2009, our consumer segment will expand beyond the U.S. to include worldwide sales to

individual consumers and select retailers as a part of an internal consolidation of our consumer business. The consolidation

will improve our global sales execution and coverage through better customer alignment, targeted sales force investments in

rapidly growing countries, and improved marketing tools. We are also designing new, innovative products with faster

development cycles and competitive features. Lastly, we have rapidly expanded our retail business in order to reach more

consumers.

– Enterprise — We are focused on simplifying IT for our customers to allow customers to deploy IT faster, run IT at a total

lower cost, and grow IT smarter. As a result of our "simplify IT" focus, we have become the industry leader in server

virtualization, power, and cooling performance.

– Notebooks — Our goal is to reclaim notebook leadership by creating the best products while shortening our development

cycle and being the most innovative developer of notebooks. To help meet this goal, we have recently separated our

consumer and commercial design functions and launched several notebook products. We expect to launch more notebook

products in Fiscal 2009.

– Small and Medium Business — We are focused on providing small and medium businesses the simplest and most complete

IT solution by extending our channel direct program (PartnerDirect) and expanding our offerings to mid-sized businesses.

We are committed to improving our storage products and services as evidenced by our new Building IT-as-a-Service

solution, which provides businesses with remote and lifecycle management, e-mail backup, and software license

management.

– Emerging countries — As a part of our growth strategy, we are focusing on and investing resources in emerging

countries — with an emphasis on Brazil, Russia, India, and China. We are also creating custom products and services to

meet the preferences and demands of individual countries and various regions.

We continue to grow our business organically and through strategic acquisitions. During Fiscal 2008, we acquired five companies, among

which the two largest were EqualLogic, Inc. ("EqualLogic") and ASAP Software Express, Inc. ("ASAP"), and we purchased CIT Group

Inc.'s ("CIT") 30% interest in Dell Financial Services, L.P. ("DFS"). We expect to continue to periodically make strategic acquisitions in

the future.

Fiscal 2008 Performance

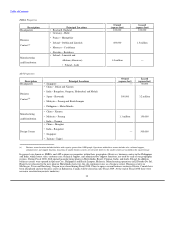

Share position • We shipped 40 million units for calendar year 2007 according to IDC, resulting in a worldwide PC share

position of 14.9%. After leading the worldwide PC market for the past six years, we fell to the second

position for calendar year 2007. We lost share, both in the U.S. and internationally, as our growth did

not meet the overall PC growth. Our U.S. Consumer segment continued to underperform, which

slowed our overall growth in unit shipments, revenue, and profitability. This was mainly due to intense

competitive pressure, particularly in the lower priced desktops and notebooks where competitors

offered aggressively priced products with better product recognition and more relevant feature sets. A

slight decline in our worldwide desktop shipments also was a factor in our losing worldwide PC share

position; worldwide desktop shipments grew 5% during calendar year 2007.

Net revenue • Fiscal 2008 net revenue increased 6% year-over-year to $61.1 billion, with unit shipments up 5% year-

over-year, as compared to Fiscal 2007 net revenue which increased 3% year-over-year to $57.4 billion

on unit growth of 2% over Fiscal 2006 net revenue of $55.8 billion.

22