Dell 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

different treatment of items for tax and accounting purposes. In determining the future tax consequences of events that have been

recognized in the financial statements or tax returns, judgment is required. Differences between the anticipated and actual outcomes of

these future tax consequences and changes in enacted tax rates could have a material impact on Dell's consolidated results of operations

or financial position.

Comprehensive Income — Dell's comprehensive income is comprised of net income, unrealized gains and losses on marketable securities

classified as available-for-sale, unrealized gains and losses related to the change in valuation of retained interests in securitized assets,

foreign currency translation adjustments, and unrealized gains and losses on derivative financial instruments related to foreign currency

hedging. Upon the adoption of SFAS No. 155, Accounting for Certain Hybrid Financial Instruments — an amendment of FASB

Statements No. 133 and 140, ("SFAS 155"), beginning the first quarter of Fiscal 2008, all gains and losses in valuation of retained

interests in securitized assets are recognized in income immediately and no longer included as a component of accumulated other

comprehensive income (loss).

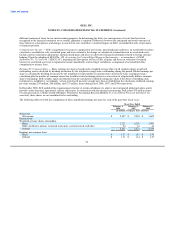

Earnings Per Common Share — Basic earnings per share is based on the weighted-average effect of all common shares issued and

outstanding, and is calculated by dividing net income by the weighted-average shares outstanding during the period. Diluted earnings per

share is calculated by dividing net income by the weighted-average number of common shares used in the basic earnings per share

calculation plus the number of common shares that would be issued assuming exercise or conversion of all potentially dilutive common

shares outstanding. Dell excludes equity instruments from the calculation of diluted earnings per share if the effect of including such

instruments is antidilutive. Accordingly, certain stock-based incentive awards have been excluded from the calculation of diluted earnings

per share totaling 230 million, 268 million, and 127 million, shares during Fiscal 2008, 2007, and 2006 respectively.

In December 2006, Dell modified the organizational structure of certain subsidiaries to achieve more integrated global operations and to

provide various financial, operational, and tax efficiencies. In connection with this internal restructuring, Dell issued 475 million shares

of common stock to a wholly-owned subsidiary. Pursuant to Accounting Research Bulletin 51, Consolidated Financial Statements (as

amended), these shares are not considered to be outstanding.

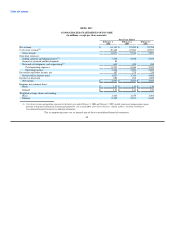

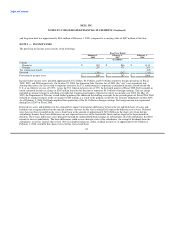

The following table sets forth the computation of basic and diluted earnings per share for each of the past three fiscal years:

Fiscal Year Ended

February 1, February 2, February 3,

2008 2007 2006

(in millions, except per share amounts)

Numerator:

Net income $ 2,947 $ 2,583 $ 3,602

Denominator:

Weighted-average shares outstanding:

Basic 2,223 2,255 2,403

Effect of dilutive options, restricted stock units, restricted stock, and other 24 16 46

Diluted 2,247 2,271 2,449

Earnings per common share:

Basic $ 1.33 $ 1.15 $ 1.50

Diluted $ 1.31 $ 1.14 $ 1.47

56