Dell 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

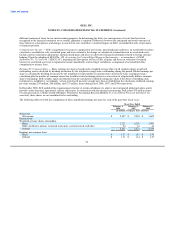

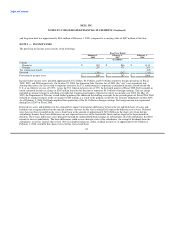

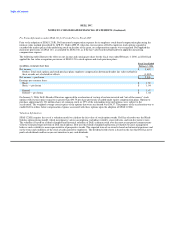

The components of Dell's net deferred tax asset are as follows:

Fiscal Year Ended

February 1, February 2,

2008 2007

(in millions)

Deferred tax assets:

Deferred revenue $ 597 $ 440

Inventory and warranty provisions 46 128

Investment impairments and unrealized gains 10 -

Provisions for product returns and doubtful accounts 61 51

Capital loss 7 13

Leasing and financing 302 222

Credit carryforwards 3 22

Stock-based and deferred compensation 188 145

Operating accruals 58 34

Other 134 125

Deferred tax assets 1,406 1,180

Deferred tax liabilities:

Property and equipment (105) (96)

Acquired intangibles (199) (16)

Other (21) (39)

Deferred tax liabilities (325) (151)

Valuation allowance - (28)

Net deferred tax asset $ 1,081 $ 1,001

Current portion (included in other current assets) $ 596 $ 445

Non-current portion (included in other non-current assets) 485 556

Net deferred tax asset $ 1,081 $ 1,001

A portion of Dell's foreign operations operate at a reduced tax rate or free of tax under various tax holidays which expire in whole or in

part during Fiscal 2010 through 2021. Many of these holidays may be extended when certain conditions are met. The income tax benefits

attributable to the tax status of these subsidiaries were estimated to be approximately $502 million ($0.23 per share) in Fiscal 2008,

$282 million ($0.13 per share) in Fiscal 2007, and $368 million ($0.15 per share) in Fiscal 2006.

In March 2007, China announced a broad program to reform tax rates and incentives, effective January 1, 2008, including introduction of

phased-in transition rules that could significantly alter the Chinese tax structure for U.S. companies operating in China. Clarification of

the rules, which phase in higher statutory tax rates over a five year period, was issued in late Fiscal 2008. As a result, Dell increased the

relevant deferred tax assets to reflect the enacted statutory rates for the year in which it expects the differences to reverse.

65