Dell 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

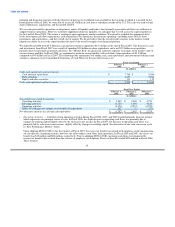

We typically repurchase shares of common stock through a systematic program of open market purchases. During Fiscal 2008, we

repurchased approximately 179 million shares of common stock for an aggregate cost of $4.0 billion as compared to 118 million shares at

an aggregate cost of $3.0 billion in Fiscal 2007 and 204 million shares at an aggregate cost of $7.2 billion in Fiscal 2006. This significant

decrease in share repurchases during Fiscal 2008 and Fiscal 2007 as compared to Fiscal 2006 is due to the temporary suspension of our

share repurchase program in September 2006. We recommenced our share repurchase program in the fourth quarter of Fiscal 2008. For

more information regarding share repurchases, see "Part II — Item 5 — Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities."

Capital Expenditures — During Fiscal 2008 and Fiscal 2007, we spent $831 million and $896 million, respectively, on property, plant,

and equipment primarily on our global expansion efforts and infrastructure investments in order to support future growth. Product

demand and mix, as well as ongoing efficiencies in operating and information technology infrastructure, influence the level and

prioritization of our capital expenditures. Capital expenditures for Fiscal 2009, related to our continued expansion worldwide, are

currently expected to reach approximately $850 million. These expenditures are expected to be funded from our cash flows from

operating activities.

Restricted Cash — Pursuant to an agreement between DFS and CIT, we are required to maintain escrow cash accounts that are held as

recourse reserves for credit losses, performance fee deposits related to our private label credit card, and deferred servicing revenue.

Restricted cash in the amount of $294 million and $418 million is included in other current assets at February 1, 2008 and February 2,

2007, respectively.

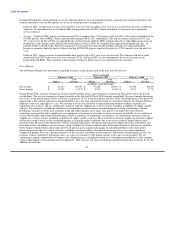

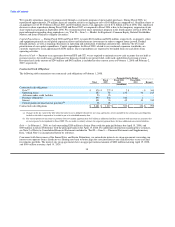

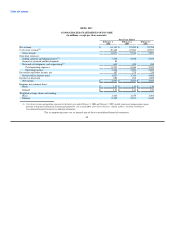

Contractual Cash Obligations

The following table summarizes our contractual cash obligations at February 1, 2008.

Payments Due by Period

Fiscal Fiscal 2010- Fiscal 2012-

Total 2009 2011 2013 Beyond

(in millions)

Contractual cash obligations:

Debt(a) $ 529 $ 227 $ 2 $ - $ 300

Operating leases 487 92 138 92 165

Advances under credit facilities 23 23 - - -

Purchase obligations 893 544 348 1 -

Interest 451 33 45 43 330

Current portion of uncertain tax positions(b) 98 98 - - -

Contractual cash obligations $ 2,481 $ 1,017 $ 533 $ 136 $ 795

(a) Changes in the fair value of the debt where the interest rate is hedged with interest rate swap agreements are not included in the contractual cash obligations

for debt as the debt is expected to be settled at par at its scheduled maturity date.

(b) The current portion of uncertain tax positions does not include approximately $1.5 billion in additional liabilities associated with uncertain tax positions that

are not expected to be liquidated in Fiscal 2009. We are unable to reliably estimate the expected payment dates for these additional non-current liabilities.

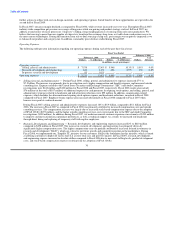

Debt — At February 1, 2008, we had outstanding $200 million in Senior Notes with the principal balance due April 15, 2008, and

$300 million in Senior Debentures with the principal balance due April 15, 2028. For additional information regarding these issuances,

see Note 2 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary

Data," which Note 2 is incorporated herein by reference.

Concurrent with the issuance of the Senior Notes and Senior Debentures, we entered into interest rate swap agreements converting our

interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate characteristics to our cash and

investments portfolio. The interest rate swap agreements have an aggregate notional amount of $200 million maturing April 15, 2008,

and $300 million maturing April 15, 2028.

38