Dell 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

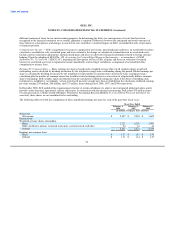

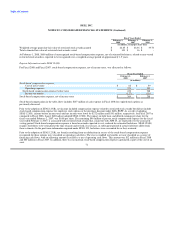

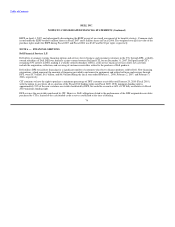

The effective tax rate differed from the statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

February 1, February 2, February 3,

2008 2007 2006

Effective tax rate:

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (18.2) (17.8) (13.9)

Tax repatriation benefit - - (1.9)

Foreign earnings subject to U.S. taxation 4.6 2.9 1.6

Imputed intercompany charges - 2.0 1.2

In-process research and development 0.8 - -

Other 0.8 0.7 (0.2)

Effective tax rate 23.0% 22.8% 21.8%

The increase in Dell's Fiscal 2008 effective tax rate, compared to Fiscal 2007, is due to the tax related to accessing foreign cash and the

nondeductibility of acquisition-related IPR&D charges offset primarily by the increase of consolidated profitability in lower foreign tax

jurisdictions during Fiscal 2008 as compared to a year ago. The increase in Dell's Fiscal 2007 effective tax rate, compared to Fiscal 2006,

is due to the $85 million tax reduction in the second quarter of Fiscal 2006 discussed above, offset by a higher proportion of its operating

profits being generated in lower foreign tax jurisdictions during Fiscal 2007.

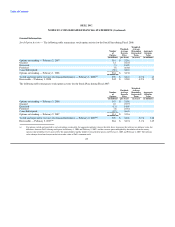

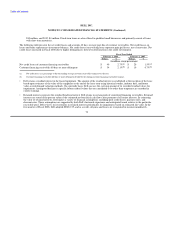

Dell adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109

("FIN 48"), effective February 3, 2007. The cumulative effect of adopting FIN 48 was a $62 million increase in tax liabilities and a

corresponding decrease to the February 2, 2007 stockholders' equity balance of which $59 million related to retained earnings and

$3 million related to additional-paid-in-capital. In addition, consistent with the provisions of FIN 48, Dell changed the classification of

$1.1 billion of income tax liabilities from current to non-current because payment of cash is not anticipated within one year of the balance

sheet date. These non-current income tax liabilities are recorded in other non-current liabilities in the Consolidated Statements of

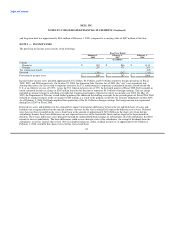

Financial Position. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Total

(in millions)

Balance at February 3, 2007 $ 1,096

Increases related to tax positions of the current year 390

Increases related to tax positions of prior years 34

Reductions for tax positions of prior years (13)

Lapse of statue of limitations (6)

Settlements (18)

Balance at February 1, 2008 $ 1,483

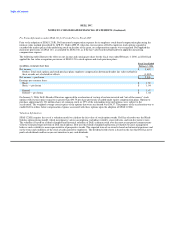

Associated with the unrecognized tax benefits of $1.5 billion at February 1, 2008, are interest and penalties as well as $171 million of

offsetting tax benefits associated with estimated transfer pricing, the benefit of interest deductions, and state income tax benefits. The net

amount of $1.6 billion, if recognized, would favorably affect Dell's effective tax rate.

Interest and penalties related to income tax liabilities are included in income tax expense. The balance of gross accrued interest and

penalties recorded in the Consolidated Statements of Financial Position at February 1, 2008

66