Dell 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Pro Forma Information under SFAS 123 for Periods Prior to Fiscal 2007

Prior to the adoption of SFAS 123(R), Dell measured compensation expense for its employee stock-based compensation plan using the

intrinsic value method prescribed by APB 25. Under APB 25, when the exercise price of Dell's employee stock options equaled or

exceeded the market price of the underlying stock on the date of the grant, no compensation expense was recognized. Dell applied the

disclosure provisions of SFAS 123, as amended by SFAS 148, as if the fair-value based method had been applied in measuring

compensation expense.

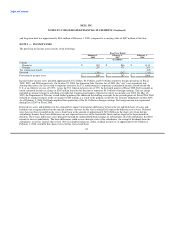

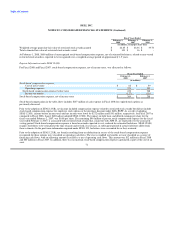

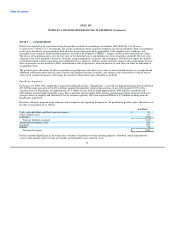

The following table illustrates the effect on net income and earnings per share for the fiscal year ended February 3, 2006, as if Dell had

applied the fair value recognition provisions of SFAS 123 to stock options and stock purchase plans:

Fiscal Year Ended

(in millions, except per share data) February 3, 2006

Net income $ 3,602

Deduct: Total stock options and stock purchase plans employee compensation determined under fair value method for

these awards, net of related tax effects (1,094)

Net income — pro forma $ 2,508

Earnings per common share:

Basic $ 1.50

Basic — pro forma $ 1.04

Diluted $ 1.47

Diluted — pro forma $ 1.02

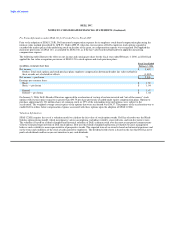

On January 5, 2006, Dell's Board of Directors approved the acceleration of vesting of certain unvested and "out-of-the-money" stock

options with exercise prices equal to or greater than $30.75 per share previously awarded under equity compensation plans. Options to

purchase approximately 101 million shares of common stock, or 29% of the outstanding unvested options, were subject to the

acceleration. The weighted-average exercise price of the options that were accelerated was $36.37. The purpose of the acceleration was to

enable Dell to reduce future compensation expense associated with these options upon the adoption of SFAS 123(R).

Valuation Information

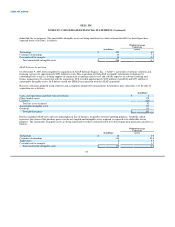

SFAS 123(R) requires the use of a valuation model to calculate the fair value of stock option awards. Dell has elected to use the Black-

Scholes option pricing model, which incorporates various assumptions, including volatility, expected term, and risk-free interest rates.

The volatility is based on a blend of implied and historical volatility of Dell's common stock over the most recent period commensurate

with the estimated expected term of Dell stock options. Dell uses this blend of implied and historical volatility because management

believes such volatility is more representative of prospective trends. The expected term of an award is based on historical experience and

on the terms and conditions of the stock awards granted to employees. The dividend yield of zero is based on the fact that Dell has never

paid cash dividends and has no present intention to pay cash dividends.

72