Cigna 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

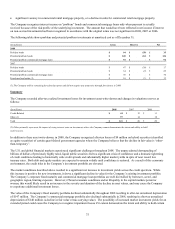

• significant vacancy in commercial rental mortgage property, or a decline in sales for commercial retail mortgage property.

The Company recognizes interest income on “problem” bonds and commercial mortgage loans only when payment is actually

received because of the risk profile of the underlying investment. The amount that would have been reflected in net income if interest

on non-accrual investments had been recognized in accordance with the original terms was not significant in 2008, 2007 or 2006.

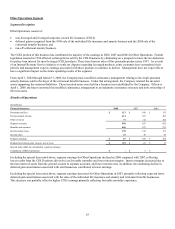

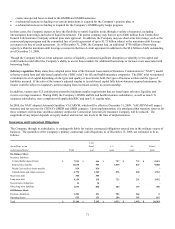

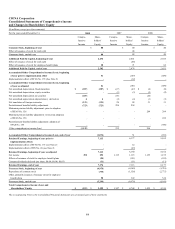

The following table shows problem and potential problem investments at amortized cost as of December 31:

(In millions) Gross Reserve Net

2008

Problem bonds $ 94 $(59) $ 35

Potential problem bonds $ 140 $(14) $ 126

Potential problem commercial mortgage loans $ 92 $ - $ 92

2007

Problem bonds $ 47 $(30) $ 17

Potential problem bonds $ 34 $(9) $ 25

Potential problem commercial mortgage loans $ 70 $ - $ 70

Foreclosed real estate (1) $ 16 $(3) $ 13

(1) The Company sold its remaining foreclosed property and did not acquire any properties through foreclosure in 2008.

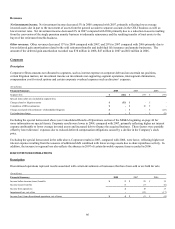

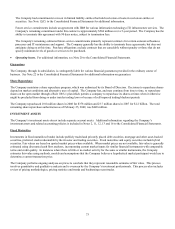

Summary

The Company recorded after-tax realized investment losses for investment asset write-downs and changes in valuation reserves as

follows:

(In millions) 2008 2007 2006

Credit-Related $ 44 $ 12 $ 11

Other (1) 97 14 18

Total $ 141 $ 26 $ 29

(1) Other primarily represents the impact of rising interest rates on investments where the Company cannot demonstrate the intent and ability to hold

until recovery.

In addition to these asset write-downs, in 2008, the Company recognized after-tax losses of $9 million on hybrid securities (classified

as equity securities) of certain quasi-federal government agencies where the Company believes that the decline in fair value is “other-

than-temporary”.

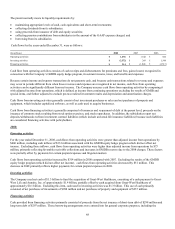

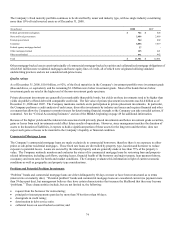

The U.S. and global financial markets experienced significant challenges throughout 2008. The unprecedented downgrading of

billions of dollars of previously highly rated, liquid public securities led to a significant crisis of confidence and a dramatic tightening

of credit conditions leading to historically wide credit spreads and substantially higher market yields in spite of near record low

treasury rates. Both debt and equity markets are expected to remain volatile until confidence is restored. As a result of this economic

environment, the credit risks in the Company’s investment portfolio are elevated.

The market conditions described above resulted in a significant net increase in investment yields across the credit spectrum. While

this increase is positive for new investments, it drove a significant decline in value for the Company’s existing investment portfolio.

The Company’s corporate fixed maturity and commercial mortgage loan portfolios are well diversified by borrower, sector, and

geographic region, limiting exposure. However, if broad economic conditions and/or illiquidity in the capital markets persist or

worsen, this would likely result in an increase in the severity and duration of the decline in asset values, and may cause the Company

to experience additional investment losses.

The value of the Company's fixed maturity portfolio declined substantially throughout 2008 resulting in after-tax unrealized depreciation

of $147 million. The Company’s commercial mortgage portfolio also declined substantially in 2008, resulting in after-tax unrealized

depreciation of $140 million (a decline in fair value versus carrying value). The possibility of increased market investment yields for an

extended period could cause the Company to recognize impairment losses if it cannot demonstrate the intent and ability to hold certain