Cigna 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

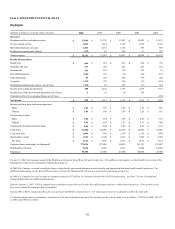

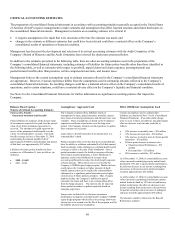

Overview of 2008 Consolidated Results of Operations

Income from continuing operations for the year ended December 31, 2008 declined significantly compared with 2007, as a result of

the following:

• The Run-off Reinsurance segment reported substantial losses in 2008, primarily due to losses in the guaranteed minimum income

benefits (GMIB) and guaranteed minimum death benefits (GMDB) businesses, reflecting the deterioration in the financial

markets and also, for GMIB, the effect of adopting Statement of Financial Accounting Standards No. (SFAS No.) 157. See the

Run-off Reinsurance section of the MD&A beginning on page 62 for additional information.

• The Company reported significant net realized investment losses in 2008 primarily due to impairments caused largely by the

deterioration in the financial markets. These losses were partially offset by gains on the sale of real estate. See the Investment

Assets section of the MD&A beginning on page 73 for more information.

• The Company’s results in 2008 were also negatively affected by the special charges for litigation and cost reduction matters

discussed beginning on page 46.

These factors were partially offset by higher segment earnings in each of the Company’s ongoing operating segments (Health Care,

Disability and Life, and International).

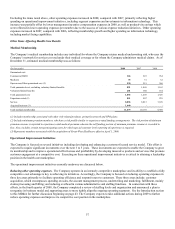

Overview of 2007 Consolidated Results of Operations

Excluding the special items discussed above, income from continuing operations decreased in 2007, compared with 2006, principally

reflecting lower realized investment gains primarily due to lower gains from sales of equity interests in real estate limited liability

entities of $145 million.

These factors were partially offset by higher earnings in the Health Care (see page 54), Disability and Life (see page 59), International

(see page 60) and Run-off Reinsurance (see page 62) segments.

Outlook for 2009

The Company expects 2009 income from continuing operations, excluding realized investments results, the results of the GMIB

business, and special items, to be higher than 2008 due to overall earnings growth in the ongoing operating segments, as well as lower

losses in the Run-off Reinsurance segment. This outlook includes an assumption that results of the GMDB business will be

approximately break-even for full-year 2009. This assumption reflects management’s view that the long-term reserve assumptions are

appropriate and that equity market conditions and volatility will return to more normal levels in 2009. The Company’s outlook is

subject to the factors cited in the Cautionary Statement and the sensitivities discussed in the Critical Accounting Estimates section of

the MD&A on pages 49 through 53. If the unfavorable equity market and interest rate movements continue, the Company could

experience additional losses related to the GMDB business.

Information is not available for management to reasonably estimate the future results of the GMIB business, realized investment gains

(losses), or to identify or reasonably estimate special items in 2009. However, if unfavorable equity market and interest rate

movements continue, the Company could also experience additional losses related to the GMIB business and investment impairments.

Potential losses related to the GMDB and GMIB businesses, as well as investment impairments, could adversely impact the

Company’s consolidated results of operations and financial condition, and could reduce the capital of the Company’s insurance

subsidiaries as well as their dividend paying capabilities.

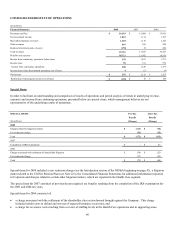

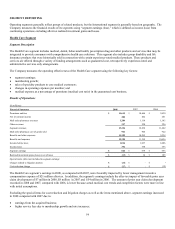

Revenues

Total revenue increased by 8% in 2008, compared with 2007; and 7% in 2007 compared with 2006. Changes in the components of

total revenue are described more fully below.

Premiums and Fees

Premiums and fees increased by 8% in 2008, compared with 2007 reflecting the impact of the acquired business, growth in the

Disability and Life segment, as well as growth and rate increases in the International segment. See segment reporting discussions for

additional detail and drivers.