Cigna 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

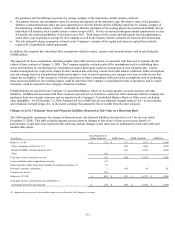

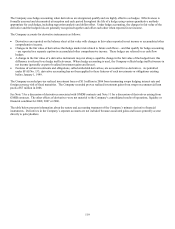

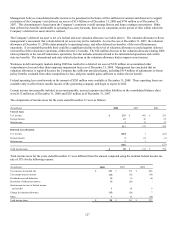

The Company uses hedge accounting when derivatives are designated, qualify and are highly effective as hedges. Effectiveness is

formally assessed and documented at inception and each period throughout the life of a hedge using various quantitative methods

appropriate for each hedge, including regression analysis and dollar offset. Under hedge accounting, the changes in fair value of the

derivative and the hedged risk are generally recognized together and offset each other when reported in net income.

The Company accounts for derivative instruments as follows:

• Derivatives are reported on the balance sheet at fair value with changes in fair values reported in net income or accumulated other

comprehensive income.

• Changes in the fair value of derivatives that hedge market risk related to future cash flows – and that qualify for hedge accounting

– are reported in a separate caption in accumulated other comprehensive income. These hedges are referred to as cash flow

hedges.

• A change in the fair value of a derivative instrument may not always equal the change in the fair value of the hedged item; this

difference is referred to as hedge ineffectiveness. Where hedge accounting is used, the Company reflects hedge ineffectiveness in

net income (generally as part of realized investment gains and losses).

• Features of certain investments and obligations, called embedded derivatives, are accounted for as derivatives. As permitted

under SFAS No. 133, derivative accounting has not been applied to these features of such investments or obligations existing

before January 1, 1999.

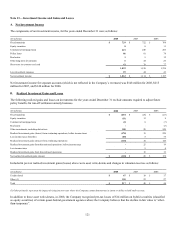

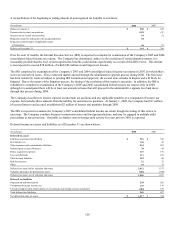

The Company recorded pre-tax realized investment losses of $11 million in 2006 from terminating swaps hedging interest rate and

foreign currency risk of fixed maturities. The Company recorded pre-tax realized investment gains from swaps on commercial loan

pools of $7 million in 2006.

See Note 7 for a discussion of derivatives associated with GMDB contracts and Note 11 for a discussion of derivatives arising from

GMIB contracts. The other effects of derivatives were not material to the Company’s consolidated results of operations, liquidity or

financial condition for 2008, 2007 or 2006.

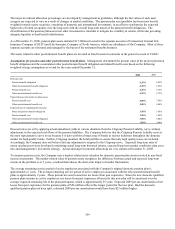

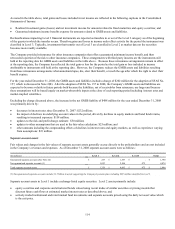

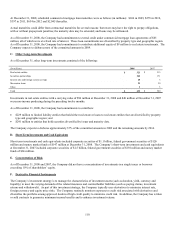

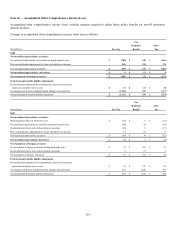

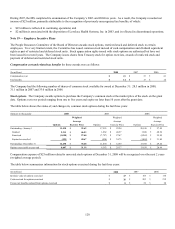

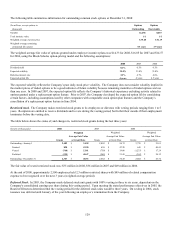

The table below presents information about the nature and accounting treatment of the Company’s primary derivative financial

instruments. Derivatives in the Company’s separate accounts are not included because associated gains and losses generally accrue

directly to policyholders.